Wall Street is currently facing challenges due to AI overvaluation fears and warnings from chief executives at Morgan Stanley and Goldman Sachs of a possible 20% equity market pullback in the next one to two years. Whether you have a bullish or bearish outlook, it’s essential to consider historical underperformers and outperformers for the month.

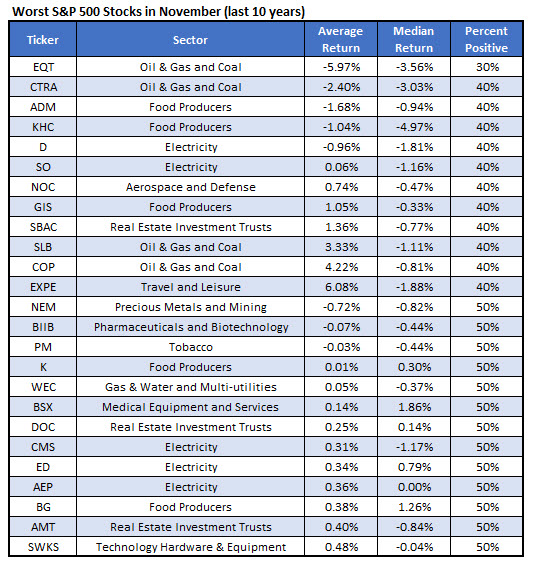

EQT Corp (NYSE:EQT) tops the list of worst S&P 500 Index names to own in November, based on data from the past 10 years. The energy company has experienced lower returns in seven out of the last ten Novembers, with an average loss of 6%.

Despite its historical performance, EQT Corp is currently on a four-day winning streak, supported by the 200-day moving average, and has a year-to-date lead of 21.5%. However, the stock has been struggling to break through long-term resistance at the $58 level since early October, following a dip in September to its lowest point since April.

Short-term options traders are displaying a more bearish sentiment towards EQT Corp than usual, as indicated by the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.73, ranking in the 91st percentile of annual readings. Additionally, options on EQT Corp appear reasonably priced, with a Schaeffer’s Volatility Index (SVI) of 40%, which is in the 20th percentile of annual readings. The stock also has a Schaeffer’s Volatility Scorecard (SVS) of 12 out of 100, indicating that it tends to underperform options traders’ volatility expectations, making it a potential candidate for selling premium.

In conclusion, despite its historical underperformance in November, EQT Corp is showing signs of strength in the current market environment. Traders and investors should closely monitor the stock’s price movements and options activity to make informed decisions about their positions.