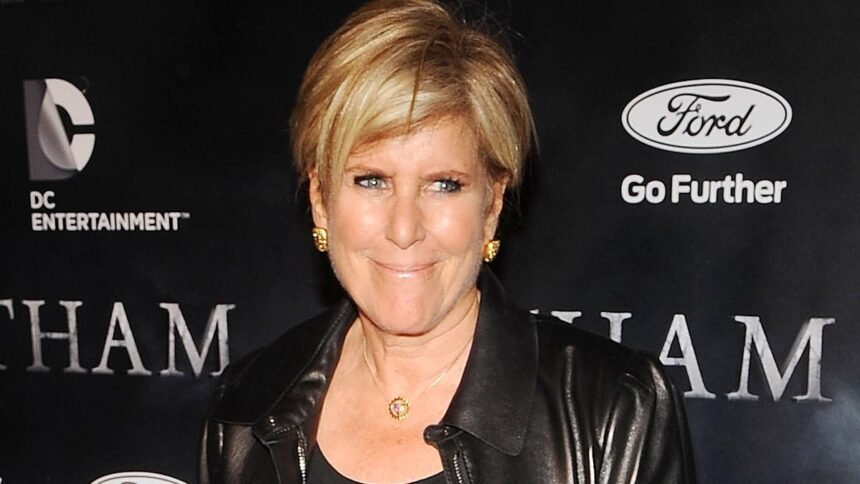

Suze Orman, a renowned financial expert, recently expressed her optimism about the stock market in a mid-May episode of her “Women & Money” podcast. She predicted that the market could experience a significant surge through the end of 2025 and into early 2026, despite potential short-term volatility. Orman emphasized the importance of long-term investing and advised against making fear-based decisions, urging investors to focus on building wealth through smart and diversified investment strategies.

In her podcast, Orman stressed the significance of diversification in an investment portfolio, recommending that investors hold a minimum of 25 to 50 individual stocks to achieve true diversification. She highlighted the benefits of index ETFs as an effective way to invest, especially for those who are not actively monitoring the market on a daily basis.

Orman also shared her insights on the types of investments that are well-positioned to thrive as the market gains momentum. She expects large growth stocks to outperform in the coming months, with tech giants like Apple, Amazon, Meta, Alphabet, and Microsoft leading the way. These companies, known as the “Magnificent Seven” and “FAANG” stocks, have historically been at the forefront of market rallies.

For investors looking for a simpler approach, Orman recommended growth-oriented ETFs such as SPYG (S&P 500 Growth ETF) and VUG (Vanguard Growth ETF). These funds consist of companies expected to outperform the broader market and can provide investors with exposure to growth stocks.

While Orman sees growth stocks as a favorable option currently, she also highlighted the importance of including core holdings in broad-based index ETFs in a long-term investment strategy. These ETFs offer diversified exposure to various sectors, providing stability and participation in market movements.

In addition to stocks, Orman also discussed the role of alternative investments such as bitcoin and gold in a well-rounded portfolio. While she once cautioned against crypto, she now believes that bitcoin is here to stay and recommended gaining exposure through ETFs like IBIT (iShares Bitcoin Trust ETF) and investing in companies like MicroStrategy (MSTR) that mirror bitcoin’s performance.

As for gold, Orman views it as a safe haven and suggested investing in the GLD (SPDR Gold Shares ETF) as a hedge against uncertainty. She advised against investing in gold miners, emphasizing the benefits of ETFs for exposure to the precious metal.

Overall, Orman’s core philosophy remains consistent: saving consistently, exercising emotional discipline, and maintaining a long-term mindset are essential for building real wealth. By following these principles and making informed investment decisions, investors can feel secure and confident in their financial future.

This article was originally published on GOBankingRates.com and provides valuable insights into Suze Orman’s perspectives on the stock market and investment strategies.