Stocks rolled over into the close yesterday, but they’re trading mostly flat this morning. Gold and silver are pulling back along with Treasuries, while crude oil and the dollar are rising.

To get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here.)

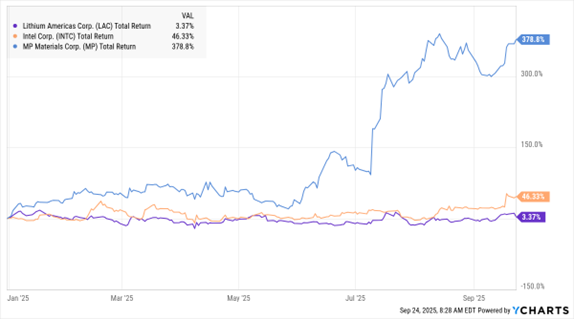

Shares of Lithium Americas Corp. (LAC) are soaring more than 70% after reports the Trump Administration will take a stake of as much as 10% in the firm. The Biden Administration had loaned LAC $2.3 billion to fund a lithium mining project in Nevada. The stake would be granted as part of a renegotiation of that financing package.

LAC, INTC, MP (YTD % Change)

Data by YCharts

The federal government has been increasing its ties with Corporate America under Trump, taking stakes in companies as wide-ranging as chipmaker Intel Corp. (INTC) and rare earth miner MP Materials Corp. (MP). LAC’s Thacker Pass project will be the largest lithium facility in the Western Hemisphere if it opens on schedule in 2028. That, in turn, would reduce the US’ reliance on China for a metal critical for electronics and Electric Vehicles (EVs).

Artificial Intelligence (AI) spending pledges just keep getting bigger – and investors keep rewarding them with higher share prices. Alibaba Group Holding Ltd. (BABA) just said it would spend much more than the $50 billion it originally announced back in February. The news sent US-traded shares of the Chinese company up more than 8% in the early going. The tech conglomerate operates cloud computing facilities in countries like the US and Australia, and will soon add data centers in Brazil, France, and the Netherlands.

See also: SPX: Two Forces are Sending Stocks Higher Despite Job Worries

Lastly, a new wave of cryptocurrency ETFs will soon hit the US markets following the release of updated Securities and Exchange Commission (SEC) guidelines. Those standards will reduce the time it takes to launch crypto ETFs dramatically, likely leading to a flood of new products that will target less-popular cryptos like Solana and XRP…or even Dogecoin. Investors can already choose from a wealth of funds that hold Bitcoin and Ethereum.

More From MoneyShow.com: