-

Realty Income has raised its dividends a remarkable 132 times and has consistently paid monthly dividends for over 50 years.

-

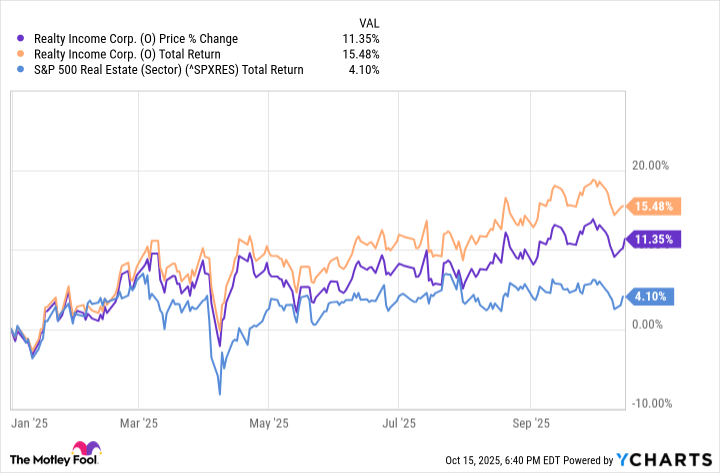

The firm outshines the real estate sector and serves as a dependable source of income.

In a world filled with uncertainties, there are precious few guarantees. As Benjamin Franklin famously noted, “nothing is certain except for death and taxes.” Yet, I believe that investors can confidently add a third certainty to this list — the dependable real estate dividend stock Realty Income (NYSE: O) and its dedication to delivering returns, regardless of market fluctuations.

Realty Income is arguably the most trustworthy dividend stock you can find, and this reputation is well earned. Realty Income has just announced its 664th consecutive monthly dividend since its inception in 1969 — a record spanning over 55 years. The firm has also increased its dividends 132 times during this timeframe, offering its shareholders a rare mix of both growth and income.

Based in California, this real estate investment trust (REIT) stands out as a top dividend stock to consider, making it an ideal choice for anyone aiming to build a dividend portfolio for the long term.

While Realty Income is rooted in California, its presence is nationwide. The company boasts 15,600 commercial properties spread across all U.S. states and significant portions of Europe. Its tenant base encompasses 91 different industries and includes over 1,600 clients.

Most importantly, the company enjoys an impressive 98.5% occupancy rate across its portfolio, ensuring a reliable revenue stream that supports its steady monthly dividends. Its tenants range from grocery and convenience stores to home improvement retailers, dollar stores, restaurants, pharmacies, fitness centers, and more.

The firm also mitigates risk through portfolio diversification, which protects it from catastrophic failures in any single industry or business. Notably, convenience store giant 7-Eleven ranks as Realty Income’s largest tenant, accounting for only 3.4% of its portfolio.

|

Top 10 Clients |

Portfolio Weighting |

|---|---|

|

7-Eleven |

3.4% |

|

Dollar General |

3.2% |

|

Walgreens |

3.2% |

|

Dollar Tree |

2.9% |

|

Life Time Fitness |

2.1% |

|

EG Group Limited |

2.1% |

|

Wynn Resorts |

2% |

|

B&Q |

2% |

|

FedEx |

1.8% |

|

Asda |

1.6% |

Data source: Realty Income. Data as of June 30, 2025.

It’s noteworthy that real estate stocks have struggled for most of the year. The S&P 500 real estate sector has experienced a mere 4% increase, largely due to a troubled housing market and elevated interest rates that inflate borrowing costs. However, Realty Income has managed to rise above these challenges, seeing its stock appreciate by 11% this year. When factoring in the total returns from reinvested dividends, this return exceeds 15%.