The Federal Reserve Lowers Interest Rates in Response to Weakening Labor Market

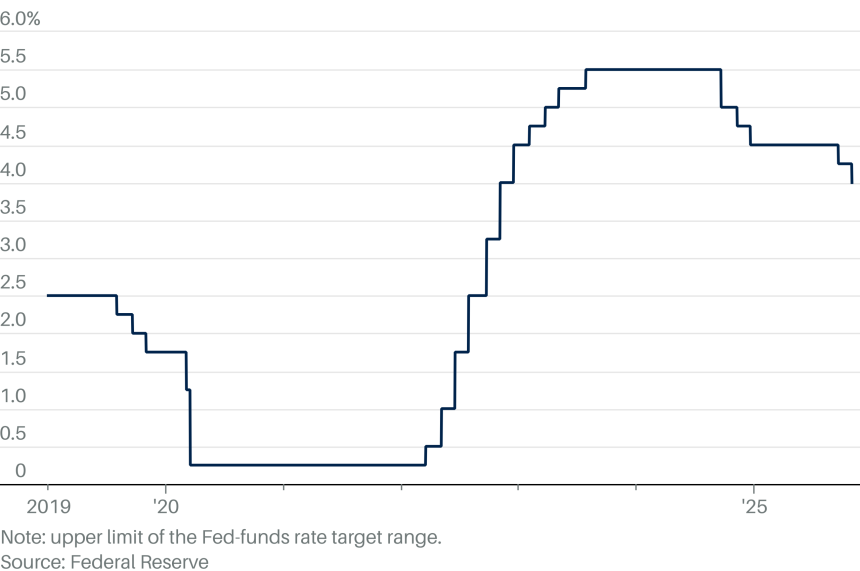

The Federal Reserve made the decision to lower interest rates by another quarter of a percentage point on Wednesday, citing concerns about a weakening labor market. This move comes at the conclusion of a two-day policy meeting where the Federal Open Market Committee voted to lower its target for the federal-funds rate to 3.75% to 4.00%, in line with expectations. Prior to the decision, the interest-rate futures market had already priced in a 100% chance of a quarter-point rate cut.

According to the FOMC statement, “Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.” This indicates that the Fed is closely monitoring the economic landscape and is prepared to take action to support the economy.

The decision to lower interest rates is seen as a preemptive move to safeguard against potential risks to the labor market. By reducing borrowing costs, the Fed aims to stimulate economic activity and support job creation. This decision comes amid growing concerns about the impact of trade tensions and global economic slowdown on the US economy.

Overall, the Federal Reserve’s decision to lower interest rates reflects its commitment to supporting economic growth and maintaining stability in the face of uncertainty. The move is likely to have implications for businesses, consumers, and financial markets, as interest rates play a key role in shaping borrowing costs and investment decisions.