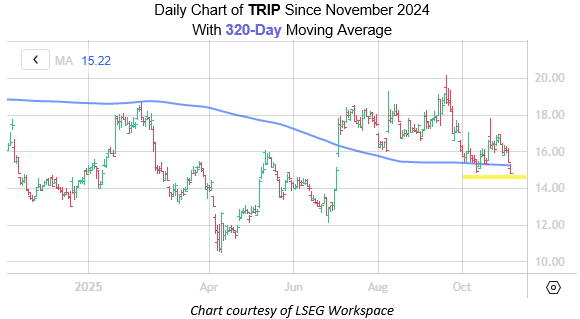

TripAdvisor Inc (NASDAQ:TRIP) stock has experienced a pullback from its 52-week high of $20.16 on Sept. 19, currently trading at $14.68. Despite this dip, there are signs pointing to a potential short-term bounce on the horizon. The stock has found support at the $14.68 level, which held losses in check during October. Additionally, TripAdvisor has come into contact with a historically bullish trendline, suggesting a possible uptick in the near future.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, the stock is within 0.75 of the 320-day moving average’s 20-day average true range (ATR). This signal has only occurred two other times in the past 10 years, with the stock seeing gains one month later 75% of the time, averaging a 15.9% increase. These statistics indicate a positive outlook for TripAdvisor in the short term.

Short covering could also play a role in boosting TRIP’s price. Currently, short interest represents a significant 21.9% of the stock’s available float, indicating a high level of bearish sentiment. If these short sellers decide to cover their positions, it could lead to a surge in the stock price.

In light of these factors, investors may want to keep a close eye on TripAdvisor Inc (NASDAQ:TRIP) in the coming weeks. With potential for a short-term bounce and short covering dynamics at play, the stock could be poised for a turnaround. As always, it’s important for investors to conduct their own research and consider their risk tolerance before making any investment decisions.