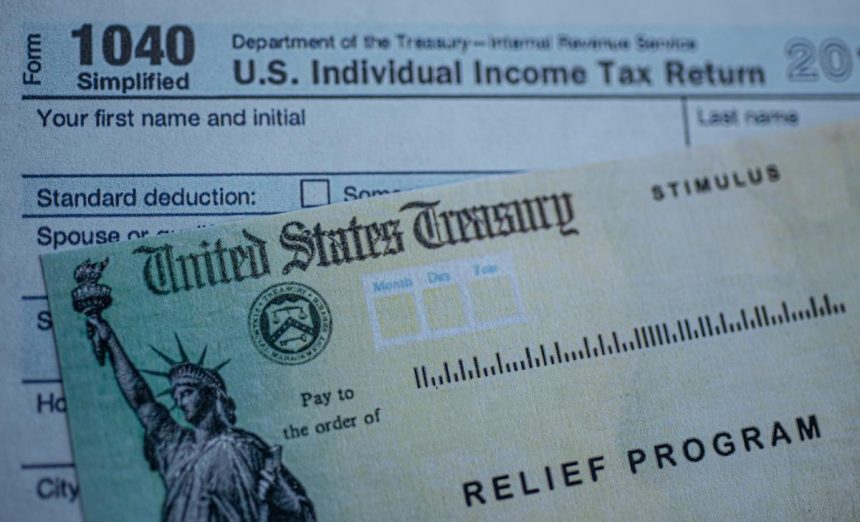

In a recent update, it has been confirmed that there will be no “relief” payments issued by direct deposit or check for the remainder of 2025, and there are no plans for such payments in 2026. Despite this, rumors of $1,390 “stimulus” checks continue to circulate, with claims of taxpayers receiving false promises of financial assistance. These rumors are often used by fraudsters and clickbait artists to deceive the public.

During a surge of misinformation this summer, the IRS issued a warning about “stimulus check scams,” clarifying that the Recovery Rebate Credit, which was the final round of government-sponsored “Economic Impact Payments” in 2021, has expired. The deadline to claim these stimulus checks was April 15, 2025, and approximately 1 million checks were issued to taxpayers who had not previously claimed the payments.

It is important to be vigilant against scams and tax fraud schemes, as even legitimate relief programs can sometimes appear dubious. Crystal Stranger, a senior tax director, highlighted that during the pandemic, stimulus checks were sent out as gift cards to taxpayers without a bank account on file, which may have seemed like a scam.

Tax-related myths and scams are a recurring issue, especially during times of economic uncertainty. Michael Cohn, an online editor, emphasized the importance of verifying information with the IRS’s official website to stay informed about available tax breaks and credits.

James Creech, a principal with a tax advisory firm, warned about the prevalence of scam artists who exploit individuals by promising quick payments. He advised against sharing bank information through unsolicited texts, emails, or websites, as the IRS never requests this information in such a manner.

While proposed relief programs like the DOGE dividend, the American Worker Rebate, and the Tariff revenue rebate have not been implemented, it is crucial to remain cautious and informed about potential financial assistance. It is recommended to consult state departments of revenue or taxation for any relief programs available at the state level.

States like New York have initiated refund check programs for residents affected by increased sales taxes due to inflation. Other states such as California, Colorado, Florida, Georgia, and New Jersey have also considered or implemented relief payments for their residents.

As federal relief payments remain uncertain, staying informed and cautious about potential scams is essential. Visit Yahoo Finance’s tax hub for comprehensive resources on filing taxes on time and managing financial obligations effectively.