Madison Investments, an investment advisor, recently released its third-quarter 2025 investor letter for the Madison Large Cap Fund. The fund experienced a 2.2% decrease in the third quarter, in contrast to the S&P 500 Index’s 8.1% gain. The fund’s underperformance was attributed to the current market focus on short-term profits.

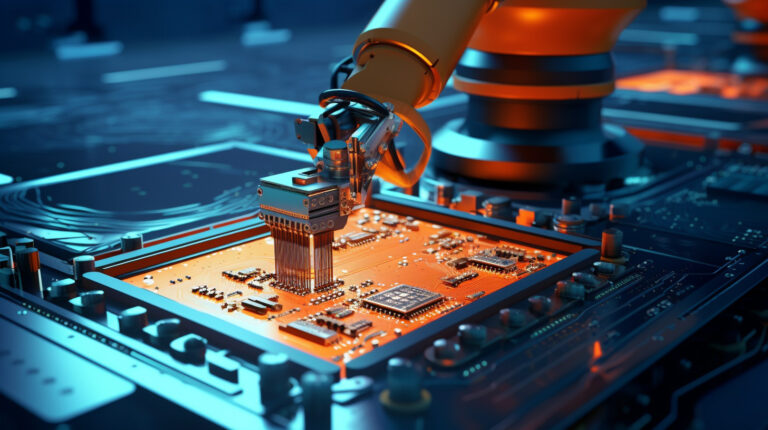

One of the highlighted stocks in the investor letter was Texas Instruments Incorporated (NASDAQ:TXN), a semiconductor manufacturer. Texas Instruments saw a one-month return of -7.68% and a 24.53% decrease in share value over the last 52 weeks. As of November 10, 2025, Texas Instruments stock closed at $160.58 per share, with a market capitalization of $145.907 billion.

In the investor letter, Madison Large Cap Fund provided insights on Texas Instruments, stating, “Texas Instruments reported a solid quarter of revenue and profits growth, but the outlook for the third quarter was below expectations as it appears some of the strong demand in the first half of the year was due to customers pulling forward orders to avoid potential tariffs.”

Despite the challenges related to tariffs, Madison Investments believes that Texas Instruments’ end markets are in the early stages of an upcycle following a significant downcycle for analog semiconductors. The fund sees potential for growth in the company’s future performance.

While Texas Instruments is not among the 30 most popular stocks among hedge funds, it remains a significant holding for many investors. In the third quarter of 2025, the company reported revenue of $4.7 billion, in line with expectations and showing sequential and year-over-year growth.

Although Texas Instruments presents investment potential, Madison Investments suggests that certain AI stocks may offer greater upside potential with less downside risk. For investors seeking undervalued AI stocks, the fund recommends exploring opportunities in the market.

Overall, Madison Investments’ third-quarter 2025 investor letter provides valuable insights into the performance of the Madison Large Cap Fund and its perspective on stocks like Texas Instruments Incorporated. Investors can download the full letter for more detailed information on the fund’s top holdings and investment strategies.