The world of investing can sometimes feel like navigating a complicated diet plan. Whether you’re looking to limit risk, maximize returns, or simply maintain a balanced portfolio, there are endless strategies and options to consider. One recent addition to the investment landscape that has caught the attention of many is Cathie Wood’s Ark Invest and their new set of ETFs, aptly named the ARK Diet ETFs.

These new ETFs are designed to offer investors exposure to Ark’s innovative strategies while also providing a level of downside protection. The concept is similar to a traditional buffer fund, where some of the potential losses are mitigated in exchange for capping the potential upside. In the case of the ARK Diet ETFs, investors can expect a 50% downside buffer and a 5% upside hurdle, with a participation rate of 50-80% beyond that.

The first ETF in this series, the ARK Diet Q4 Buffer ETF (ARKT), was launched at the end of September and is reset annually. The value of ARKT is based on the performance of Ark’s flagship ETF, the ARK Innovation Fund (ARKK). This structure allows investors to benefit from Ark’s innovative approach while also providing a level of protection against market volatility.

The holdings of ARKT are structured using options in addition to the equity position in ARKK. These options expire in September 2026 and include a mix of call options, covered call sales, and put purchases. This strategy is designed to provide downside protection, limit upside potential, and capture a portion of any gains in ARKK over a 12-month period.

While this setup may sound complex, the real test will be how ARKT performs in different market environments. Depending on the fluctuations in ARKK’s price, ARKT could prove to be a valuable addition to a portfolio or may fall short of expectations. The fund’s prospectus emphasizes the importance of buying and holding ARKT for the full 12-month period to meet its objectives.

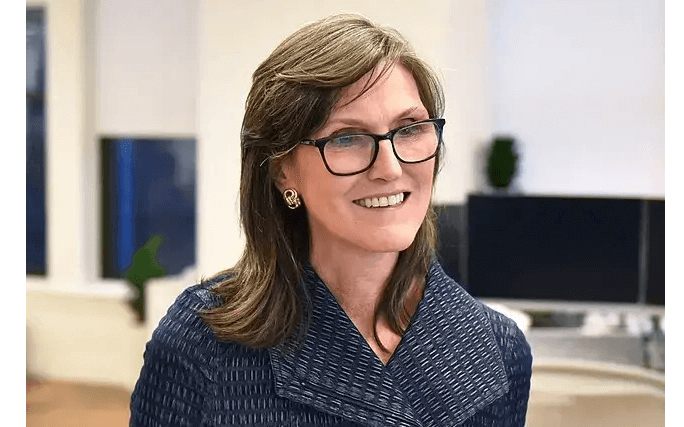

Overall, the concept of the ARK Diet ETFs is certainly intriguing, but investors should keep a close eye on the performance of ARKK itself. As of late, ARKK has been relatively flat, raising questions about the effectiveness of the ETF’s strategy. Ultimately, the success of any investment comes down to the skill and expertise of the manager, and in this case, that manager is Cathie Wood and her team at Ark Invest.

In conclusion, the ARK Diet ETFs offer a unique opportunity for investors to access Ark’s innovative strategies with a level of downside protection. While the concept is promising, only time will tell if these ETFs can deliver on their objectives. As with any investment, it’s important to carefully consider your own financial goals and risk tolerance before diving into the world of ETFs.