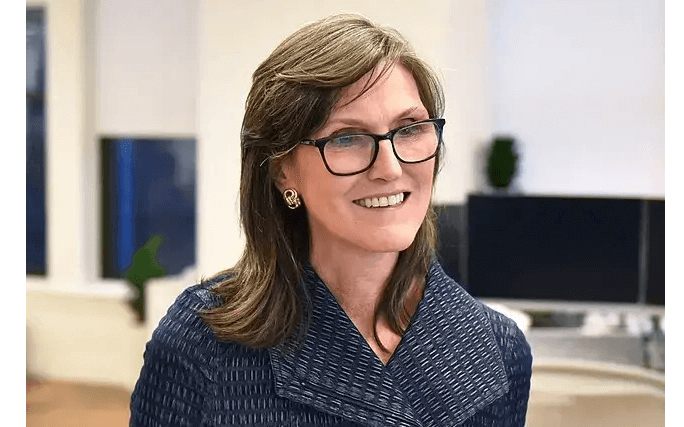

Cathie Wood, the renowned investor known for her ability to spot disruptive technology trends early, has curated a portfolio of top tech stocks for 2026 that could be worth considering for your own investment strategy. These three companies – Trimble (TRMB), Amazon (AMZN), and Nvidia (NVDA) – are at the forefront of technological innovation and poised for growth in the coming years.

Trimble, a precision technology company, has undergone a transformation from a hardware-focused business to a software powerhouse. With 65% of its revenue now coming from recurring sources, Trimble boasts stable cash flows and a growing annual recurring revenue of $2.5 billion. The company targets underserved markets in construction and transportation, with a total addressable market of around $50 billion for its construction software business. Trimble’s Connect and Scale strategy focuses on integrating workflows and data across its platforms, making it difficult for customers to leave once they’re embedded in the ecosystem.

Amazon, the e-commerce giant, continues to dominate the online retail space while its cloud computing arm, Amazon Web Services (AWS), powers the artificial intelligence revolution. AWS experienced 20% growth, expanding its power capacity to meet the increasing demand for AI services. Amazon’s custom Trainium chips are gaining traction in the market, offering superior price performance compared to competitors. The company’s advertising revenue saw a 22% year-over-year increase, reflecting its success in capturing a wide range of customers.

Nvidia, a leader in AI chips, is positioned to capitalize on the expanding data center infrastructure market. With expectations of booking between $350 billion and $400 billion in revenue next year, Nvidia’s growth trajectory shows no signs of slowing down. The company’s Grace Blackwell platform and Vera Rubin architecture demonstrate its commitment to innovation and staying ahead of the competition.

Analysts are bullish on these stocks, with strong buy recommendations for Trimble, Amazon, and Nvidia. The average price targets for these companies are well above their current prices, indicating potential upside for investors. As Cathie Wood’s conviction in these names reflects broader trends in automation, cloud computing, and artificial intelligence, keeping an eye on these tech stocks in 2026 could prove to be a smart investment move.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as investment advice. The author does not hold any positions in the securities mentioned. For more information, please refer to the original article published on Barchart.com.