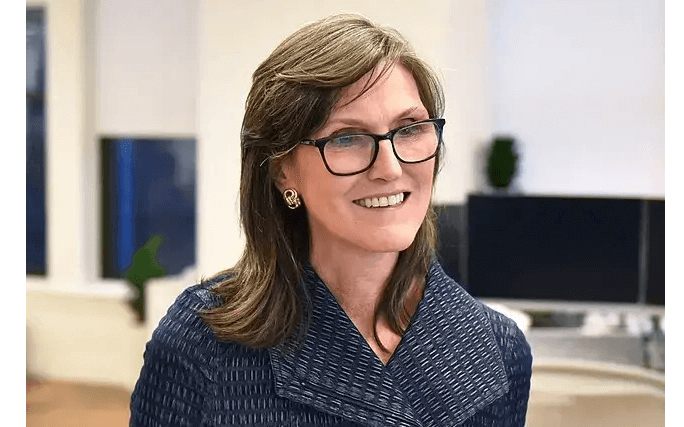

After enduring a few challenging years of underperformance, Cathie Wood made a remarkable comeback in 2025. Her flagship ARK funds showcased impressive gains, surpassing major U.S. benchmarks. This resurgence was fueled by the resurgence of disruptive technology themes, such as artificial intelligence (AI) and robotics, aligning perfectly with ARK’s investment strategy.

Despite this success, controversy still surrounds Wood’s portfolio, particularly regarding her significant position in Tesla (TSLA). Although Wood has reduced her Tesla holdings multiple times recently, it remains the largest holding in her core ARK funds. This has raised questions about whether Wood is losing confidence in her famous bet or simply engaging in disciplined portfolio management.

Tesla, a leading innovator in sustainable energy, focuses on developing and selling high-performance electric vehicles, solar energy systems, and energy storage products. The company also offers various related services and is increasingly investing in AI, robotics, and automation. With a market cap of $1.44 trillion, Tesla is a significant player in the industry.

At the start of the year, Tesla’s stock experienced a slight decline of nearly 4%, following Nvidia’s announcement of Alpamayo, an AI-powered system for autonomous vehicles. Despite this, Tesla remains at the forefront of innovation in the electric vehicle space.

In 2025, Cathie Wood’s ARK funds significantly outperformed the broader market, with the ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW) each gaining around 35%. Wood’s focus on disruptive technologies like AI and robotics drove this success. Looking ahead, Tesla remains Wood’s top conviction bet, representing a significant portion of her ARK portfolios.

While Wood has been trimming her Tesla position, these moves are attributed to standard portfolio rebalancing and profit-taking. Tesla’s recent fourth-quarter vehicle delivery numbers showed a slight decline, partially due to the end of the EV purchase tax credit. However, the company reported growth in its energy business, providing a source of earnings stability amidst challenges in the core EV business.

Investors are eagerly awaiting Tesla’s fourth-quarter earnings report, expected to shed light on the company’s progress in AI and robotaxis. With Tesla’s stock trading at a high valuation, much hinges on the success of its autonomy technology and the launch of a viable self-driving service. Tesla’s robotaxi program will be a key focus in 2026, with expectations for expansion to multiple cities.

Wall Street analysts hold mixed views on TSLA stock, with some recommending a “Strong Buy” while others suggest holding or selling. Despite trading above the average price target, Tesla still offers upside potential to the highest Street target.

In conclusion, Cathie Wood’s resurgence in 2025 and Tesla’s ongoing innovations in AI and robotics set the stage for an exciting year ahead. As the company continues to focus on expanding its robotaxi services and advancing its autonomy technology, investors will closely monitor its progress and performance.