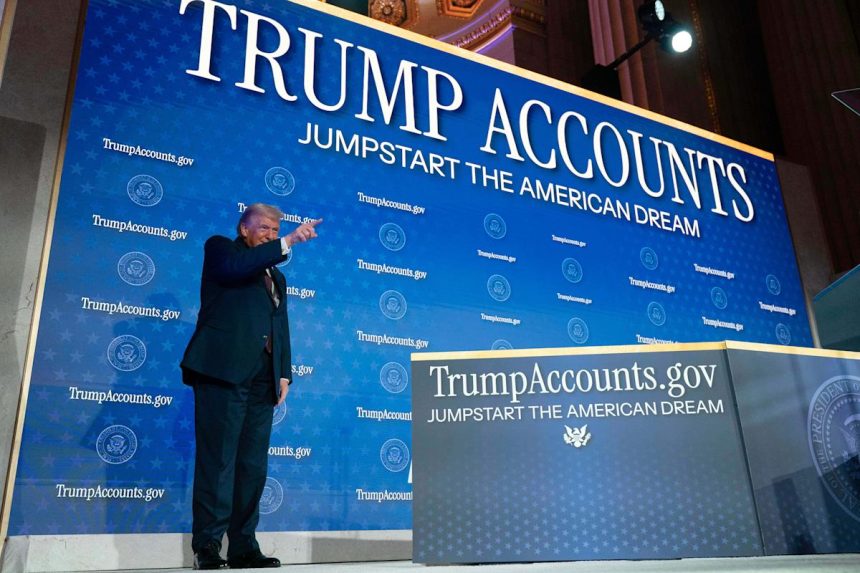

Millions of Trump accounts, the new savings accounts for children, are set to receive an initial deposit of $1,000 from the U.S. Treasury. This seed money is being matched by nearly three dozen companies and philanthropists who have pledged their own donations to support this initiative.

Experts believe that these savings accounts, coupled with employer contributions, have the potential to revolutionize the conversation around saving early for children’s futures. While any child under 18 with a Social Security number can establish the IRA-like savings account, only those born between Jan. 1, 2025, and Dec. 31, 2028, will receive the $1,000 deposit directly from the government as a one-time seed money.

Parents, employers, family members, friends, and even charitable organizations and state governments can contribute up to $2,500 per year, with a $5,000 annual cap on contributions. Contributions from charitable organizations and state governments do not count towards the annual limit. Treasury Secretary Scott Bessent has revealed that 20 U.S. states are actively working to meet the administration’s “50 State Challenge” to help fund these accounts.

A growing number of companies and philanthropists have pledged to match donations to Trump accounts. Some of the companies include Block, Inc., Broadcom, Coinbase, Dell Technologies, IBM, Intel, Nvidia, Charter Communications, Chipotle Mexican Grill, Comcast, Continental Resources, Steak ‘n Shake, Turning Point USA, and Uber.

On the philanthropic front, notable figures such as Michael and Susan Dell, Ray Dalio and his wife Barbara, Brad Gerstner, and Nicki Minaj have made significant pledges to support eligible children in various regions.

Citi recently joined the list of contributing companies, announcing its matching program on Feb. 5. Brandee McHale, president of the Citi Foundation, expressed enthusiasm about the potential impact of Trump accounts in helping families build assets. Citi Foundation has pledged $5 million to raise awareness about the program and support enrollment.

Lindsey Stanberry, a family financial advisor, believes that Trump accounts could shift the conversation around saving for children’s futures. She highlighted the similarity between Trump accounts and 401(k) plans, emphasizing the importance of employer matching programs in encouraging families to invest in these accounts.

In addition to Trump accounts, families can also consider IRAs, 529 plans, and education savings accounts as options for saving for their children’s futures. Stanberry noted that while 529 accounts have higher contribution limits and tax benefits for education expenses, Trump accounts offer more flexibility in terms of usage.

Families can leverage both Trump accounts and 529 plans to maximize their child’s educational funding and overall financial well-being. Babylist.com offers a helpful page comparing Trump accounts and 529s to guide families in making informed decisions about their children’s financial future.

Overall, the introduction of Trump accounts presents a unique opportunity for families to prioritize saving early and building wealth for their children. It is essential for families to explore all available options and utilize different financial tools to secure a stable financial future for their loved ones.