“Wheel Candidate” – A Timeless Strategy for Quality Stocks

The classic Wheel strategy is a tried and true approach for traders looking to generate income while potentially acquiring shares of quality stocks. It involves selling cash-secured puts on stocks that the trader is comfortable owning. If the put expires worthless, the trader collects premium and repeats the process. If the put is assigned, the trader transitions to selling covered calls on the shares.

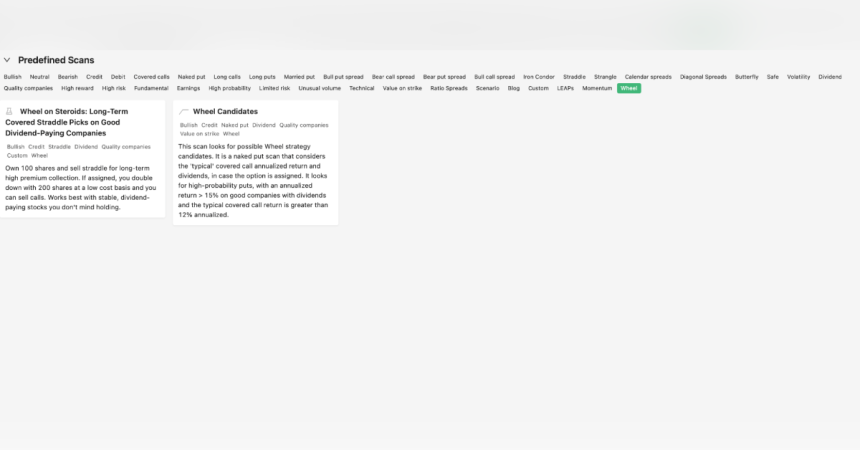

One way to streamline this process is to use the predefined “Wheel Candidates” scan on the Option Samurai options screener. This scan focuses on identifying naked put opportunities on high-quality, dividend-paying companies with reasonable probabilities and projected annualized returns. It also takes into account the potential returns from covered calls in case of assignment, ensuring a balanced approach throughout the Wheel strategy.

“Wheel on Steroids” – Enhancing the Wheel Strategy with Covered Straddles

For more experienced traders with sufficient capital, the Wheel strategy can be taken to the next level by incorporating covered straddles. This advanced technique involves owning 100 shares of a stock and selling both a call and a put at the same strike and expiration date, maximizing premium intake.

The “Wheel on Steroids: Long-Term Covered Straddle Picks on Good Dividend-Paying Companies” scan is specifically designed for traders looking to implement this strategy. It targets stable, dividend-paying companies where long-term ownership is acceptable and volatility allows for selling both call and put options.

This approach focuses on generating consistent income through premium collection over time. If the put side of the trade is assigned, the trader acquires additional shares at a lower cost basis, enabling them to sell covered calls on a larger share count. It’s a methodical approach that prioritizes cash flow from fundamentally strong companies over quick profits.

Using an options screener is crucial when executing covered straddles, as this strategy amplifies both income potential and risk. By filtering for company quality, dividend stability, and manageable risk, traders can ensure a more measured and deliberate approach to their trades.

Whether you’re a fan of the classic Wheel strategy or looking to take it up a notch with covered straddles, these techniques offer a structured and systematic way to generate income while investing in quality stocks. By leveraging options screeners and focusing on fundamental strength, traders can navigate the market with confidence and precision.