The Market Response to the Recent Election: A Comprehensive Analysis

In my previous post, I made a passing comment about the market response to the recent election which may have been misconstrued. Today, I aim to provide a more thorough interpretation of how the markets reacted to the election results.

Following the election, there were several notable market responses:

- Significant increase in stock prices

- Strength in the dollar

- Rise in interest rates

- Higher inflation expectations in the TIPS market

While I sarcastically remarked on the media’s portrayal of these responses as positive, it is important to delve deeper into the implications of these market movements.

Leading up to the election, there was a prevailing narrative in the media that the public held a pessimistic view of the economy. Despite strong indicators such as a booming job market and record stock prices, the focus seemed to be on concerns about high inflation in the coming years.

Considering this backdrop, the market response to the election, particularly the rise in inflation expectations, could be seen as a negative signal. It suggests that investors anticipate inflationary pressures in the future.

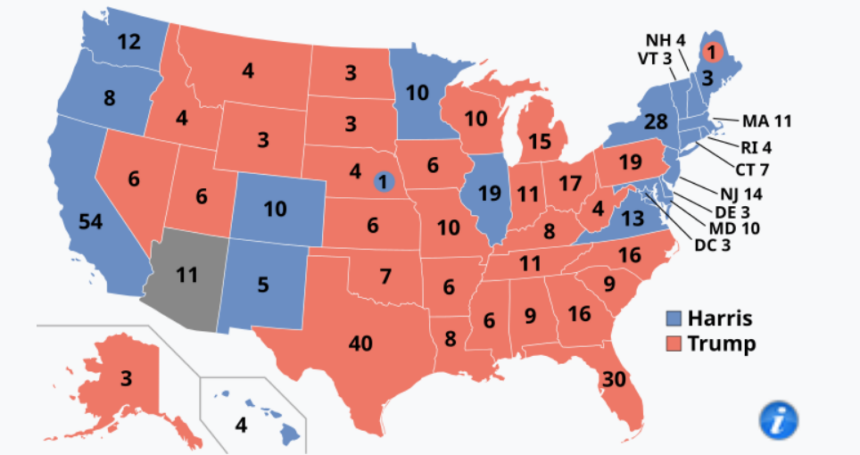

Delving into the reasons behind these market reactions, the surge in stock prices can be attributed in part to expectations of lower corporate taxes under the new administration. Additionally, the Republican control of both the House and Senate likely played a role in shaping market sentiment.

Expectations of stronger GDP growth may have also contributed to the rise in stock prices. While some of the proposed policies could boost growth, others such as tariffs and immigration restrictions could have a dampening effect.

The increase in inflation expectations is closely tied to the anticipated impact of tariffs. The Federal Reserve may have to navigate this landscape carefully to prevent excessive price hikes resulting from trade barriers.

The appreciation of the dollar can also be linked to expectations of higher tariffs. This adjustment in the currency’s value could offset the benefits to domestic producers from increased trade barriers.

Furthermore, the uptick in interest rates likely reflects expectations of larger budget deficits. Both candidates had proposals that could exacerbate deficits, with the Republican agenda leaning towards more drastic tax cuts.

Despite the initial market reactions post-election, it is important to note that these responses are provisional. As more information about the new administration’s policies emerges, markets will continue to reassess and reprice assets accordingly.

In conclusion, while market reactions provide valuable insights into investor sentiment, they are subject to change as new developments unfold. It is crucial to monitor how economic policies evolve and their impact on market dynamics.

PS. The rise in stock prices of Fannie Mae and Freddie Mac post-election raises concerns about perpetuating crony capitalism. Addressing the moral hazard in the financial system remains a pressing issue that requires careful consideration.