The importance of upholding the rule of law over the law of rulers cannot be overstated. Regardless of one’s political beliefs or affiliations, it is essential to prioritize the principles of justice and fairness in governance. This sentiment is particularly relevant when considering the issue of “court packing”, a practice that undermines the independence and integrity of the judicial system.

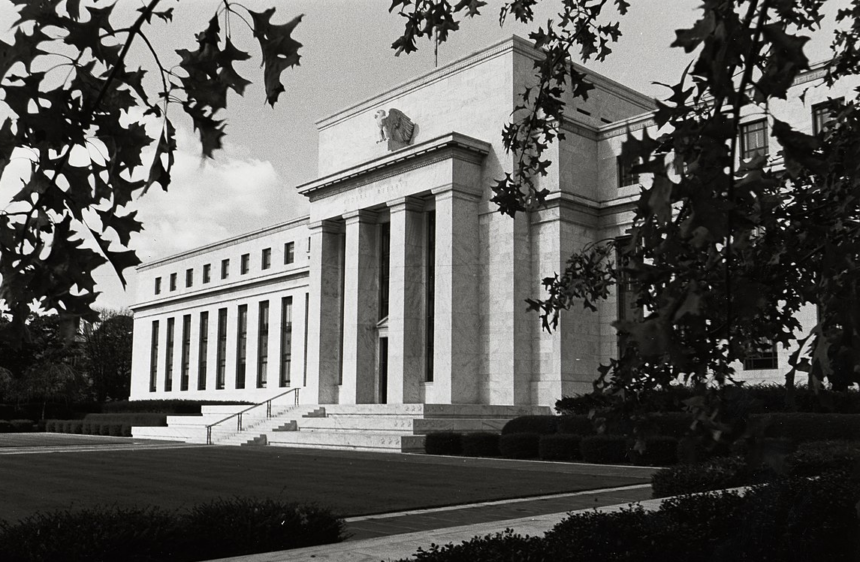

An often overlooked aspect of Federal Reserve rules is the setting of the interest rate on bank reserves. While the Federal Open Market Committee (FOMC) typically collaborates on this decision, technically, it is the seven-member Federal Reserve Board that has the authority to determine this crucial rate. This distinction is significant, as it underscores the importance of maintaining a balance of power within the Federal Reserve system.

In a recent article by Benn Steil in Barron’s, the potential implications of President Trump exploiting this loophole to reshape the Federal Reserve are discussed. Section 505 of former Sen. Richard Shelby’s draft 2015 Financial Regulatory Improvement Act proposed transferring the authority to set the interest rate on reserves to the FOMC, thereby restoring the full committee’s control over short-term rates. However, this proposal faced objections from Democrats who raised concerns about the quasi-private nature of Reserve Bank presidents serving on the FOMC.

President Trump’s influence over the Federal Reserve could be significant, particularly through his appointments to the Federal Reserve Board. By strategically appointing individuals who align with his policy objectives, Trump could exert control over the Board’s decisions on interest rates. This potential manipulation of the Federal Reserve’s power dynamics highlights the importance of maintaining the institution’s independence and integrity.

The reluctance of Democrats to grant more power to regional bank presidents within the Federal Reserve system reflects a broader concern about the implications of centralized control. While regional bank presidents may have differing perspectives on monetary policy, granting excessive authority to a subgroup controlled by the executive branch could have unintended consequences. It is essential to consider the long-term implications of restructuring institutional power dynamics to prevent potential abuses of authority.

A similar example can be seen in the delegation of tariff-setting authority to the Executive Branch by Congress. While this delegation was intended to provide flexibility in trade negotiations, it also opened the door to unilateral decision-making on tariff rates. The framers of the Constitution vested Congress with the power to set tax rates and tariffs for a reason – to ensure accountability and oversight in economic policy decisions.

In conclusion, the debate over the distribution of power within government institutions underscores the importance of upholding the rule of law and maintaining a balance of powers. By prioritizing transparency, accountability, and independence in governance, we can safeguard against the erosion of democratic principles and protect the integrity of our institutions.