In the realm of policy-making, there is a constant tug-of-war between decisions that yield immediate gratification and those that lead to long-term benefits. This dichotomy often poses a significant challenge, especially when it comes to tackling pressing issues like global warming. Unfortunately, the existing political structures around the world are ill-equipped to effectively address such complex and far-reaching problems.

One classic example that exemplifies this conflict is the issue of public debt. The unpopular decisions required to reduce public debt, such as implementing higher taxes and cutting spending, tend to be met with resistance in the short term. However, these measures are crucial for ensuring financial stability in the long run. As a result, the reluctance to make tough choices leads to a worsening fiscal situation over time, with the public debt spiraling out of control.

Another area where this dilemma is prominent is in bank regulation. While the ideal scenario would involve minimal to no regulation, the introduction of measures like deposit insurance and policies for handling “too-big-to-fail” institutions have made this option unfeasible. Without adequate regulation, banks would have the incentive to engage in risky behavior with taxpayers’ money, potentially leading to catastrophic consequences.

The next best alternative is imposing higher capital requirements on banks. However, the complexity of these rules often allows savvy financial institutions to find loopholes and circumvent the intended regulations. Additionally, the concept of “greater supervision” is akin to vague promises by politicians to address budget deficits by tackling “waste, fraud, and abuse,” lacking concrete strategies for effective oversight.

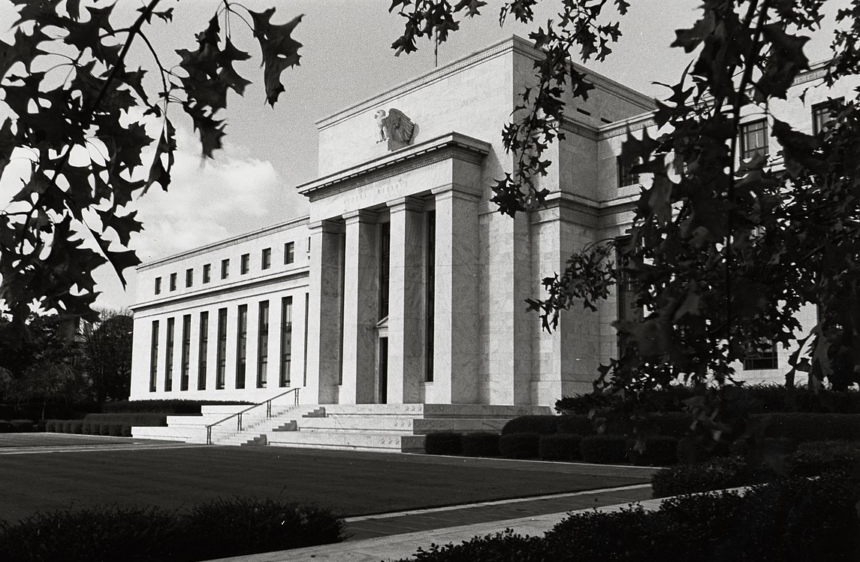

A recent article from Bloomberg sheds light on the potential reshaping of the Federal Reserve’s leadership under President-elect Donald Trump. The consideration of individuals like Fed Governor Michelle Bowman for key roles raises questions about the effectiveness of bank regulation. While Bowman advocates for better supervision over increased capital requirements, the recent Supreme Court ruling on the Chevron decision has further muddied the waters for regulatory effectiveness.

In light of the Supreme Court’s decision curtailing federal agencies’ power to interpret laws, the ambiguity surrounding bank regulation laws poses a significant challenge. With the need for clearer guidelines and stronger oversight, the current regulatory framework may struggle to address the complexities of the banking system effectively. As uncertainties loom over the future of bank regulation, it remains crucial to find a delicate balance between short-term appeasement and long-term sustainability in policymaking.