The Flawed Argument for Tariffs Leading to Lower Prices

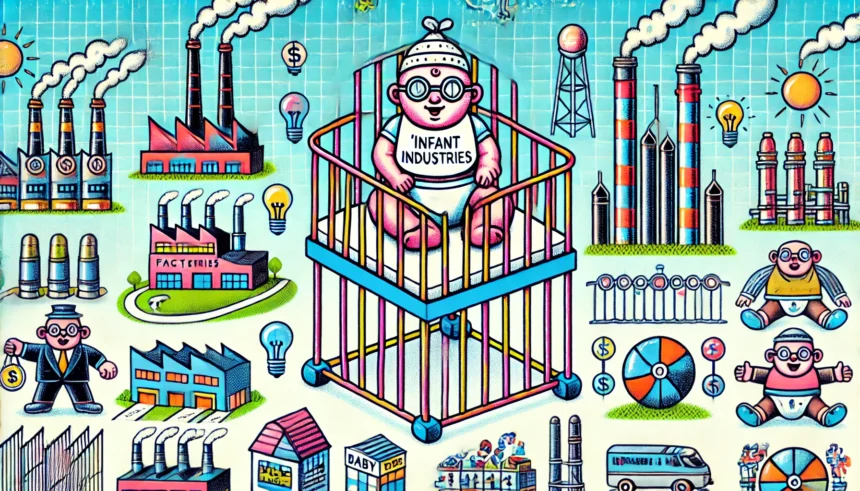

There is a common argument in favor of protectionist tariffs that suggests tariffs will ultimately result in lower prices for consumers. This argument is often rooted in a modified version of the infant industry argument, where domestic firms struggle to compete with foreign competition, and tariffs are seen as a way to level the playing field and spur the growth of domestic industries. The theory goes that once tariffs are in place, prices will initially rise, prompting new domestic firms to enter the market and eventually drive prices back down to pre-tariff levels or even lower.

While this argument may seem plausible on the surface, it overlooks a fundamental flaw: tariffs are not necessary to achieve these goals. If it were truly profitable for firms to operate at a scale that could match or surpass free-trade prices, they would already be doing so. The presence of capital markets allows firms to access funding to expand their operations and seize profitable opportunities. The idea that politicians could identify these profit opportunities better than market participants, who are driven by self-interest and profit motives, seems highly unlikely.

Financial markets play a crucial role in allocating resources efficiently over time. Firms and individuals can borrow funds to invest in new technologies, projects, and expansions that may take years to yield returns. The sheer volume of transactions in financial markets highlights the level of expertise and knowledge that exists in the private sector. It is hard to imagine that politicians could outperform these market participants in identifying profitable opportunities.

Furthermore, the process of implementing tariffs is lengthy and public, involving debates, votes, and public hearings. If a tariff were to truly create new profit opportunities, this information would quickly become public knowledge, leading investors to rush into the affected markets to capitalize on these opportunities. In essence, any potential benefits from tariffs would likely be short-lived as market forces quickly adjust to the new conditions.

In conclusion, while it is theoretically possible for tariffs to lead to lower prices, the likelihood of this scenario playing out as intended is slim. At best, tariffs would simply recreate the status quo with added bureaucratic steps and administrative costs. Ultimately, relying on tariffs to lower prices is likely to result in a less efficient outcome compared to free-market dynamics.