Alphabet Inc., the parent company of Google, recently released its fourth-quarter revenue figures, which fell short of analysts’ expectations. The company reported quarterly sales of $81.6 billion, excluding partner payouts, missing the projected $82.8 billion. This news caused Alphabet’s shares to drop more than 9% in after-hours trading.

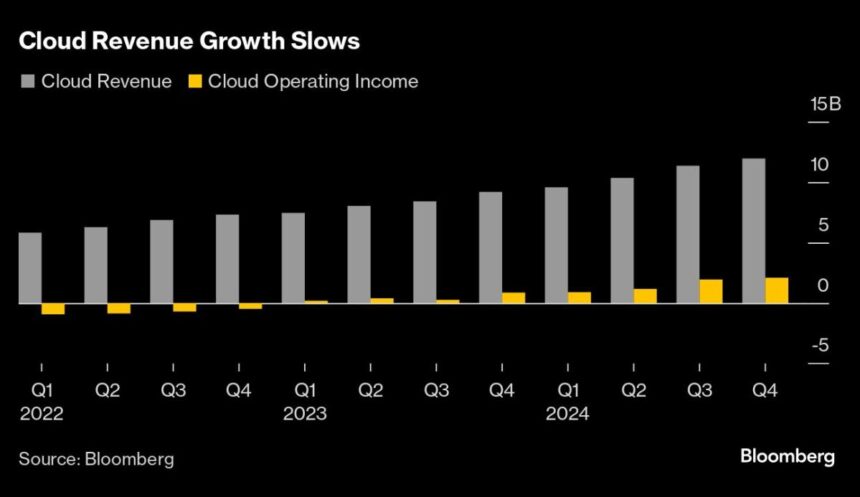

One of the main concerns raised by investors is the slowdown in growth of Alphabet’s cloud business. The company announced $75 billion in capital expenditures for 2025, surpassing analysts’ expectations of $57.9 billion. This significant investment is aimed at driving revenue by providing customers with the necessary tools and resources. However, Google’s cloud unit reported sales of approximately $12 billion in the last quarter, falling short of estimates and trailing behind competitors like Amazon and Microsoft.

Alphabet’s CEO, Sundar Pichai, emphasized the importance of continuing to invest in the cloud to meet the increasing demand from customers, especially startups requiring enhanced computing power. Despite the company’s efforts to lead in artificial intelligence, competition in the market is intensifying, with Chinese startup DeepSeek gaining attention for developing a powerful AI model at a lower cost than US rivals.

As Alphabet faces pressure to demonstrate the business gains from its investments in AI, analysts warn that the company’s advantages in AI and search could diminish this year. Additionally, there is a growing focus on the potential benefits for companies specializing in AI chips, rather than those developing AI models.

Alphabet’s revenue from search advertising exceeded expectations, generating $54 billion in sales. However, the company is facing challenges in the search market, with ongoing antitrust allegations and legal battles expected to unfold in 2025. YouTube reported revenue of $10.5 billion, driven by early investments in podcasts that boosted ad spending during the US election.

Alphabet’s Other Bets, which include futuristic businesses like Verily and Waymo, generated $400 million in revenue, falling short of estimates. Waymo, the self-driving car division, is expanding rapidly and plans to test in 10 new cities this year. The company is also working on cost-saving measures for its driving technology.

In conclusion, Alphabet’s latest financial results reflect the challenges and opportunities in the rapidly evolving tech industry. As the company continues to invest heavily in AI and cloud technology, it faces pressure to demonstrate the tangible benefits of these investments to investors and stakeholders. The competition in the AI market is fierce, and Alphabet must navigate these challenges to maintain its position as a leader in the industry.