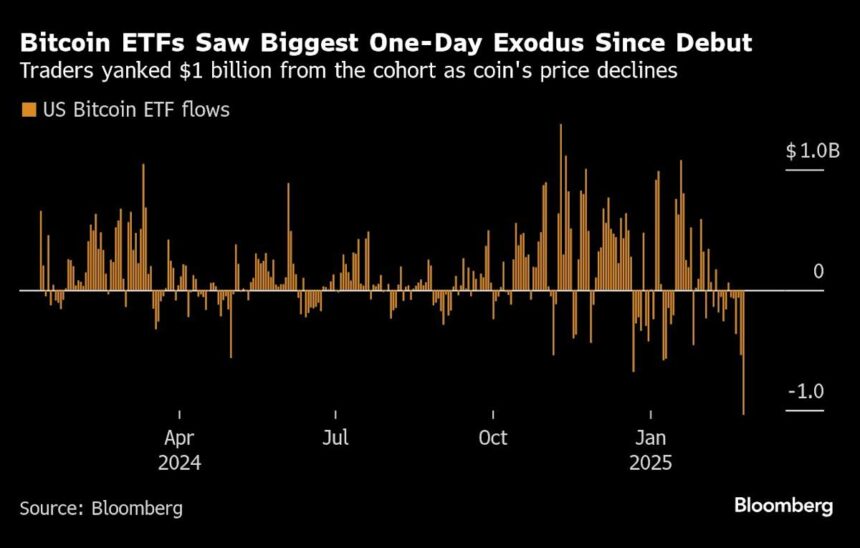

Investors pulled over $1 billion from spot Bitcoin exchange-traded funds on Tuesday, marking the largest one-day outflow since these funds were introduced in January. The Fidelity Wise Origin Bitcoin Fund (FBTC) experienced the most significant outflows, followed by the iShares Bitcoin Trust ETF (IBIT), as Bitcoin’s price struggles amidst market uncertainty. In total, Bitcoin funds lost around $2.1 billion over six consecutive days, the longest stretch of outflows since last June.

The world’s largest digital asset has faced pressure this week, with its price dropping to its lowest level since mid-November following a record high earlier this year. Other cryptocurrencies also saw declines, with a leading index of top digital tokens on track for its most substantial four-day drop since early August.

While Bitcoin funds are seeing a mass exodus, investors seized the opportunity during a recent stock market selloff to inject nearly $7 billion collectively into the Invesco QQQ Trust (QQQ) and SPDR S&P 500 ETF Trust (SPY).

Geoff Kendrick, global head of digital assets research at Standard Chartered, noted that digital assets remain heavily influenced by retail flows, despite institutional interest in the past year. This difference from equities and fixed income suggests that average investors may have shallower pockets to weather losses, potentially leading to more significant market volatility.

Kendrick predicts that Bitcoin could trade even lower, possibly around the $80,000 range, at which point he plans to “buy the dip.” According to Matthew Sigel, VanEck’s head of digital-asset research, the record outflows may stem from hedge funds unwinding a popular trading strategy known as the basis trade, which leverages price differences between spot and futures markets. Some investors utilized ETFs to profit from Bitcoin’s volatility or hedge against short positions in derivatives.

Sigel stated, “This strategy involves buying Bitcoin spot (often through ETFs) while simultaneously shorting Bitcoin futures to lock in a low-risk return. However, the profits from this trade have recently collapsed, making it far less attractive. As a result, hedge funds that were using ETFs for this strategy have likely closed their positions, leading to significant redemptions.”

It is also possible that newer investors in the crypto space, who are more prone to panic, have contributed to the outflows, according to Stephane Ouellette, CEO, and co-founder of FRNT Financial Inc. Ouellette noted, “Those investors are less indoctrinated into the space, simply due to the fact that they do not have their infrastructure to hold physical BTC.” He emphasized that characterizing ETF outflows as investors “not buying the dip” may be too strong.

In conclusion, the cryptocurrency market continues to face challenges as investors navigate market volatility and uncertainty. The evolving dynamics of digital assets and the interplay between retail and institutional investors shape the market’s movements and trends. As the crypto landscape continues to evolve, investors must stay informed and adaptable to navigate the ever-changing market conditions.

This rewritten content seamlessly integrates into a WordPress platform, providing valuable insights into the current state of the cryptocurrency market.