Exploring Recent Housing Trends and Debates

As I perused through various housing articles, a few key insights caught my attention:

1. The Impact of Low-Rent Properties on Investment Returns

A recent study by Sven Damen, Matthijs Korevaar, and Stijn Van Nieuwerburgh delves into the intriguing relationship between residential properties with the lowest rent levels and their propensity to provide the highest investment returns. The research, spanning housing markets in the United States, Belgium, and The Netherlands, uncovers a consistent trend across time and regions. Surprisingly, low-rent units seem to offer a hedge against business cycle risks, contrary to conventional wisdom. The segmentation of investors, with larger corporate landlords veering away from the low-tier segment, sheds light on the complexities of the housing market dynamics. Financial constraints play a crucial role in shaping risk-adjusted returns, ultimately impacting low-income tenants in the form of high rent burdens.

2. Debunking the Housing Bubble Myth

Challenging the notion of a housing bubble, recent analyses suggest that real housing prices have fully rebounded to pre-2008 levels. While some argue that alternative metrics of housing affordability paint a different picture, the looming question remains: Are we on the brink of another market crash reminiscent of 2008?

3. The Role of Housing Prices in Interstate Migration

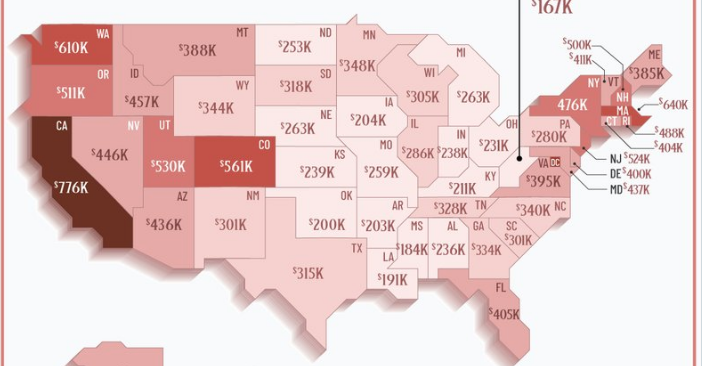

The ongoing debate surrounding the migration from blue states to red states brings to the forefront the pivotal role of housing prices. Building restrictions in blue states, driving up housing costs, serve as a catalyst for the migration patterns observed. However, the nuances of interstate migration reveal that housing costs alone do not dictate population shifts. Factors such as state income tax policies, weather conditions, and overall quality of life contribute to the complex dynamics influencing migration trends.

4. Austin’s Remarkable Rent Decline

An intriguing case study in Austin showcases the transformative impact of housing construction on rent prices. With a significant influx of developers and new rental units entering the market, Austin witnessed a staggering 22% decline in rents from its peak. The rapid growth in supply, fueled by corporate relocations and a surge in remote workers seeking affordability and amenities, underscores the profound impact of housing development on rent affordability.

These diverse housing trends and debates underscore the multifaceted nature of the real estate market, shaped by a myriad of factors ranging from investment patterns and regulatory influences to demographic shifts and economic dynamics.