Graphics processing units (GPUs) are currently the focal point of generative AI development, making them a crucial component of the hardware landscape. Over the past few years, investing in semiconductor stocks has been a lucrative venture, given the widespread use of GPUs and data centers. However, the beginning of 2025 has not been favorable for chip stocks, with various factors like Chinese startup DeepSeek, new tariffs imposed by U.S. President Donald Trump, and high investor expectations contributing to a decline in the market.

Despite the challenges faced by chip stocks, there is one company that stands out amidst the broader selling in the semiconductor industry – Taiwan Semiconductor Manufacturing Company (TSMC). TSMC plays a vital role in manufacturing chips and integrated systems for semiconductor companies, enabling companies like Nvidia and AMD to bring their chip designs to life. While Nvidia and AMD often steal the spotlight, TSMC’s contributions are fundamental to the success of many industry leaders.

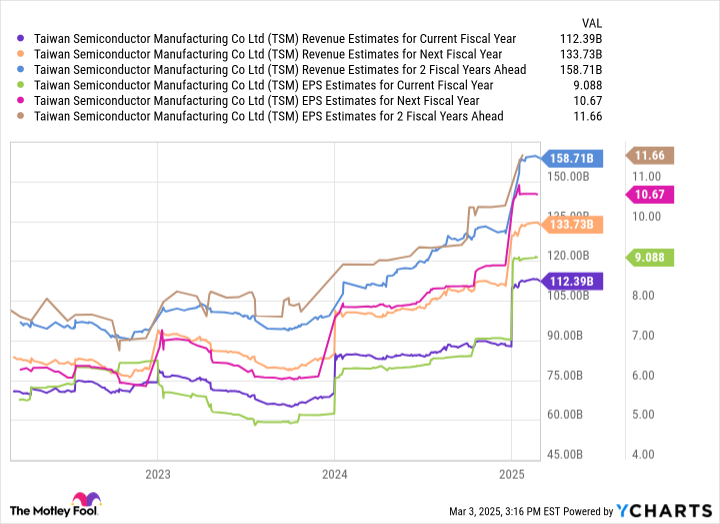

With the increasing demand for GPUs in recent years, Taiwan Semi has experienced significant revenue and profit growth. As the company’s operations continue to expand, particularly in custom silicon solutions, its position in the market is expected to strengthen further. Big tech companies like Microsoft, Amazon, and Alphabet are turning to TSMC for custom chip designs to support their AI initiatives, indicating a promising future for the company.

Despite its strong market position and financial outlook, TSMC’s stock remains undervalued. The company’s forward price-to-earnings ratio is lower than the average for the S&P 500, presenting an attractive investment opportunity. While there are risks associated with the cyclical nature of the semiconductor industry and geopolitical tensions between China and Taiwan, the overall outlook for chip demand remains robust.

In an effort to mitigate risks and expand its global footprint, TSMC recently announced plans to invest $100 billion in expanding its manufacturing operations in the U.S. This strategic move aligns with the increasing investments in AI infrastructure by big tech companies, positioning TSMC for long-term growth.

In conclusion, Taiwan Semiconductor Manufacturing Company presents a compelling opportunity for investors looking to capitalize on the AI revolution. By leveraging its expertise in foundry solutions and custom chip manufacturing, TSMC is well-positioned to benefit from the growing demand for advanced semiconductor technologies. Consider exploring TSMC as a potential investment to ride the wave of the AI revolution and tap into the company’s growth potential.