Unlock the White House Watch newsletter for free

Are you interested in staying informed about the 2024 US election and its implications for Washington and the world? Look no further than the White House Watch newsletter, your guide to all things related to this pivotal event. And the best part? You can now unlock this newsletter for free!

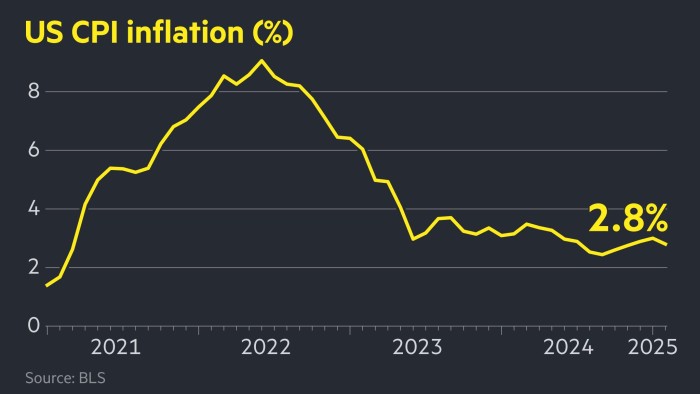

In recent news, US inflation has fallen more than expected to 2.8 per cent in February. This decrease has bolstered the case for the Federal Reserve to cut interest rates, especially in light of signs of slowing growth in the world’s largest economy. The annual consumer price index figure for February was below both January’s 3 per cent and the 2.9 per cent expected by economists.

Despite the recent slip in US stocks, Wednesday saw a positive turn with the blue-chip S&P 500 closing 0.5 per cent higher and the tech-heavy Nasdaq Composite adding 1.2 per cent. Futures markets are now pricing in two rate cuts this year, with an 85 per cent chance of a third cut – slightly higher than before the release of the latest data.

The Federal Reserve is facing a challenging balancing act as it navigates bringing down inflation without triggering a recession. Many are concerned that President Donald Trump’s economic policies may be hindering growth, especially with the chaotic rollout of tariffs on the country’s biggest trading partners.

Core inflation in the US rose 3.1 per cent, falling slightly short of expectations. However, economists remain cautiously optimistic about the Fed’s ability to manage inflation and plan for potential cuts later in the year.

Last week, Fed chair Jay Powell reassured the public about the health of the US economy, despite disappointing employment figures for February. The Fed is expected to hold rates steady at its upcoming meeting, with Powell emphasizing the importance of separating signal from noise as the economic outlook evolves.

In a related development, the Bank of Canada announced a quarter-point cut in interest rates to 2.75 per cent, citing the expected slowdown due to trade tensions and tariffs imposed by the United States. The BoC highlighted the uncertainty surrounding the economic outlook, especially in light of the rapidly evolving policy landscape.

Some economists and investors are concerned that Trump’s tariffs could lead to increased inflation. The recent tariffs on steel and aluminum imports have already triggered retaliatory measures from the EU, further escalating trade tensions.

Despite the positive news of February’s inflation drop, concerns remain about the impact of tariffs on various sectors of the economy. It’s important to stay informed and monitor these developments closely as they unfold.

Stay tuned for more updates on the US economy and the latest news on the 2024 US election by unlocking the White House Watch newsletter for free. Your source for insightful analysis and expert commentary on all things Washington and beyond.