Emerging markets are experiencing a resurgence in investor interest as concerns about the US economy push traders to seek opportunities abroad. The ongoing trade tensions and tariff policies of President Donald Trump are expected to impact US growth, prompting portfolio managers to look towards emerging markets for potential returns.

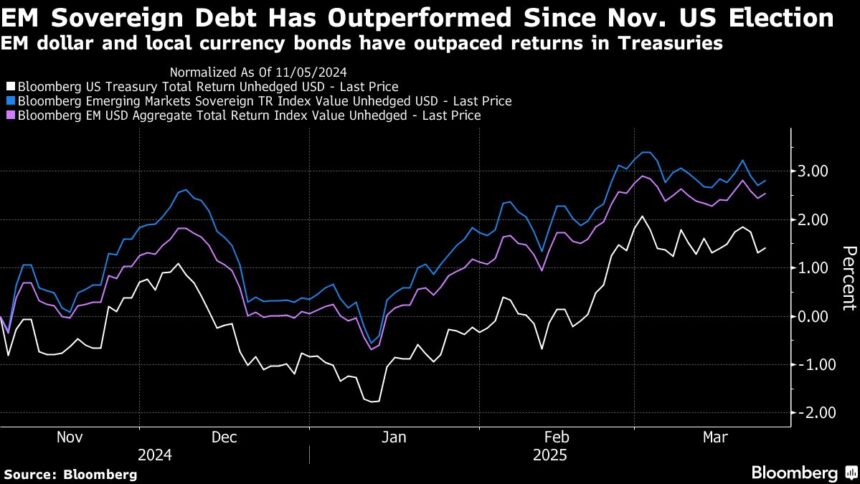

This shift in focus has led to a rally in emerging market equities, with the best first quarter performance since 2019. A weaker dollar has also boosted developing currencies by almost 2% this year, while local bonds have seen gains as well. Valuations in emerging markets are now considered cheap compared to more developed markets, attracting investors looking for opportunities outside the US.

While investors have faced disappointments in the past decade with the dominance of US stocks, the current rally in emerging markets could be sustained by a potential slowdown in US growth. The hope is that a cooling US economy, driven by tariffs and trade tensions, could lead to lower Treasury yields and a weaker dollar, benefiting emerging market assets. Additionally, expectations of increased spending in Europe and stimulus measures in China could provide support if the US economy falters.

Many analysts believe that emerging market assets are undervalued compared to US equities, presenting an opportunity for investors to diversify their portfolios. The shift away from US exceptionalism towards emerging markets is expected to be a long-term trend, with the potential for significant growth in stocks, bonds, and currencies.

Investors are looking at opportunities in regions such as Latin America and Eastern Europe, where the performance gap with US stocks is narrowing. Funds are investing in sovereign debt from countries like Colombia, South Africa, Indonesia, Philippines, and South Korea, citing higher liquidity and market access. The unwind of US exceptionalism, including a weaker dollar, is seen as positive for emerging markets, with many currencies posting gains against the dollar this year.

While there are risks that could derail this trend, such as a stronger-than-expected US economy or less severe tariffs, investors remain optimistic about the prospects for emerging markets. Some are maintaining cash holdings as a precaution, but overall, the outlook for emerging markets appears promising amidst the current global economic landscape.