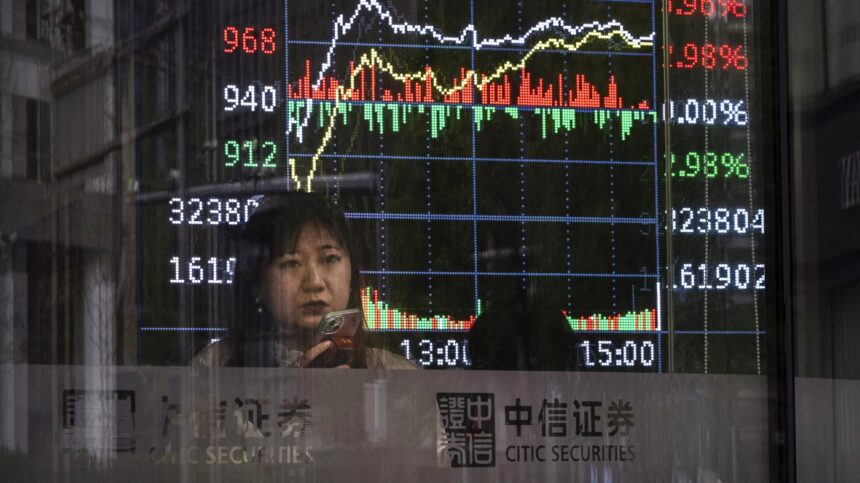

A stock ticker shows trading at a securities firm in Beijing April 9.

Kevin Frayer/Getty Images AsiaPac

hide caption

toggle caption

Kevin Frayer/Getty Images AsiaPac

President Trump’s sweeping “Liberation Day” tariffs have upended the global economy, sending stock markets into turmoil.

“This is, without a doubt, the biggest trade policy shock, I think, in history,” Zanny Minton Beddoes, the editor-in-chief of The Economist, says.

Trump last week ordered a minimum 10% tax on nearly everything the U.S. buys from other countries. He’s also ordered much higher levies on things the country buys from China, Japan and the European Union. However, a lot of those tariffs are in flux, because almost each day the president has either increased some tariffs or paused others.

“Presidents from Reagan to President Biden have increased tariffs on individual goods or individual sectors, but nothing like this. So this is off the charts in terms of scale, … speed and uncertainty,” says Minton Beddoes, who is a former economist for the International Monetary Fund.

While the motivation behind the tariffs remains unclear, she says that the Trump administration could be seeking to “radically remake the rules of global security, geopolitics, economics.”

Minton Beddoes says the president seems to believe that the U.S. is getting a bad deal in the global economy, and that the tariffs will be used as a tool to renegotiate trade agreements: “It might be exactly what President Trump loves. Lots of people coming, knocking on his door, fawning, hoping for a good deal. This is The Art of the Deal on steroids,” she says.

But, Minton Beddoes adds, the economic turmoil caused by the tariffs creates “a lot uncertainty, and a lot pain for consumers because tariffs are taxes on consumers. The people who pay this in the end, the cost of the tariffs, are people who pay more for the things that they buy.”

“I think we’ve crossed some kind of a Rubicon in the last week or so, and we’re not going to go back to the world as it was before,” she says. “People, I think, are increasingly looking at the U.S. Rather than being seen as the shining city on the hill that we all admired and respected, the United States is now perceived as a bullying, swaggering, selfish, transactional country. This shift in perception reflects a change in our approach to trade, where tariffs are being used either as a means to re-industrialize America or as negotiating tools. The administration’s goal is to bring manufacturing back to the U.S., creating jobs and boosting the economy. However, this approach may not be beneficial in the long run, as it could lead to higher costs for consumers, turmoil in the stock market, and retaliation from other countries. A tariff war with China, for example, could have severe consequences for both nations, resulting in significant economic losses and escalating tensions. Ultimately, the path the U.S. is currently on may not be the most advisable or beneficial for its economy and global relations.

The Dangerous Dynamic of Imposing Tariffs

It is a very precarious situation when the United States imposes tariffs on everyone, including both friends and foes. This action undermines one of the core strengths of the country, which is its alliance system and the strong relations it has with many nations. The U.S. has always been seen as the country that established and maintained the global trade and security rules, but now it appears to be turning away from that role. This shift presents an opportunity for China to step in geopolitically.

Monique Nazareth and Anna Bauman produced and edited this interview for broadcast. Bridget Bentz and Molly Seavy-Nesper adapted it for the web.