Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When it comes to saying the unsayable, it’s hard to top comedian Jerry Sadowitz’s infamous gag from the late 1980s. “Nelson Mandela, what a c***. You lend some people a fiver and you never hear from them again.”

The joke shocked — if you haven’t stopped reading already — not because the future president of South Africa was still incarcerated at the time. It was the first line. Mandela was already far beyond reproach. Sanctified even.

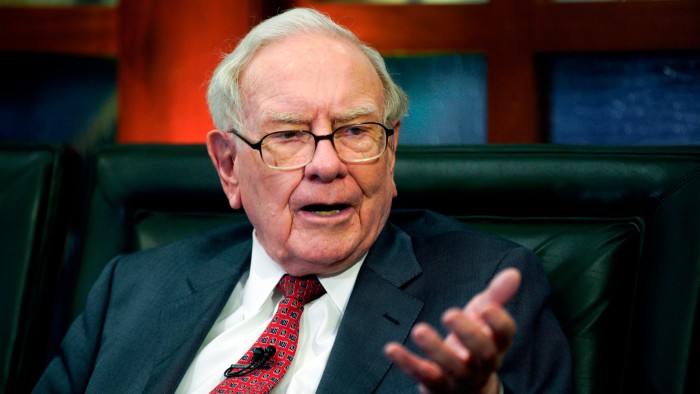

Just as Warren Buffett is today (although if you’d lent him $5 in the early 1960s, it’d be worth almost three hundred grand now). His reputation is unsulliable. Such is the universal love for Buffett that even China’s securities regulator praised him when he announced his retirement last week.

But our worship is weirdly ironic. Whereas no one doubts Mandela’s suffering and subsequent grace, the “Sage of Omaha” himself questions the very thing we venerate. Buffett is both the god of active investing as well as its harshest critic. According to his many sermons on the impossibility of outperforming an index over long periods, his record shouldn’t exist.

Though here we are — celebrating as gospel truth how the equivalent one loaf of bread in 1965 was turned into 52,000 today. That’s an annual compound return of 20 per cent — twice that of the S&P 500. And yet as Buffett wrote himself in 1975, anyone looking for above average returns is “doomed to disappointment”.

How has this paradox endured? That we trust wholeheartedly in Buffett’s ability to produce supernatural performance while at the same time he says stockpicking is heresy. Our little brains should explode with the inconsistency of it. The only explanation is that we don’t actually agree with Warren’s view of active management.

After all, the congregation of global money managers, wealth advisers, analysts and economists remains huge. Well over half of the $50tn invested in funds is still trying to beat a benchmark, despite a woeful record of success. Among Warren’s US peers in active fund management, for example, 90 per cent of them have underperformed index funds over the past two decades, according to S&P Global Ratings data.

Sure passive investing is winning souls. But our core faith in active management is unshakeable it seems. When Buffett easily won his famous wager in 2008 that a broad index of US stocks would beat the world’s best hedge fund managers over 10 years, did we run screaming to our brokers to sell our active funds? No we did not. Even if everyone is doomed to fail when it comes to generating long-run alpha — save Buffett of course — we don’t accept it.

Cognitive scientist Justin Barrett reckons humans are predisposed to religious belief from birth. We are naturally receptive to gods, an afterlife and moral absolutes. It is surely thus with active management, too. And perhaps for the same reasons.

Succumbing to the Vanguards of this world represents a life with no purpose, where even trying to understand companies or bonds or valuation is a waste of effort. It’s nihilism in an ETF wrapper — with the index representing death. Alternatively, what can be more life-affirming than fundamental research, buying and selling, and pitting your wits against the market for riches and glory?

Therefore we idolise Buffett because we are primed to. Analysts can write as much as they want on how his excess returns are due to the leverage he employs from recycling the loss reserves of his insurance companies. Or Buffett admits he may have just flipped heads 20 times in a row. No one cares — it doesn’t fit our world view.

Hence the mass pilgrimages to Omaha. And our hanging off Buffett’s words, even if they’re occasionally like the ramblings of a drunk uncle at Christmas. “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.” Er, OK Warren. Berkshire Hathaway’s celestial $770,000 price for its A class shares adds to the mystique, as does not blessing mortals with a dividend.

So yes, we adore Warren. But our love of stockpicking is eternal. Just as second comers lose no faith when Jesus fails to show, nor Catholics when popes are swapped, Berkshire Hathaway’s share price only fell 6 per cent in early trades after Buffett said he was stepping down at the end of this year.

It would have fallen to earth if investors really thought Buffett was irreplaceable. The radiance of active management, it seems, is brighter than even “the single most influential investor of all time”. Who knows if we will come to revere Greg Abel but few will want him to fail.

stuart.kirk@ft.com

Recommended

Warren Buffett

A deep dive into the mind of the Oracle of Omaha.

Read More

Therefore, the paradox of worshipping active management while heeding Buffett’s warnings against it continues to puzzle and intrigue investors worldwide. As we navigate the complex world of investing, the legacy of Warren Buffett and the eternal allure of stockpicking remain central to our financial beliefs.