Do stablecoins pose a significant threat to the effectiveness of monetary policy? This question was explored in a recent episode of Conversations With Tyler:

DIXON: I foresee a future where every bank will likely issue a stablecoin, akin to how they distribute credit cards. Each institution will cater to its users with a convenient “Send a stablecoin” button. My hope is that a sufficient number of credible players will emerge to create a network effect, thereby minimizing the impact of any potential malfeasance.

COWEN: In such a scenario, do we conclude that the Federal Reserve loses control over the money supply? If someone creates a stablecoin backed by a Treasury bill, it resembles a private open-market operation. I’m fine with that idea, but it raises questions about the Fed’s control. Could this become a macroeconomic concern?

DIXON: I feel like I’m conversing with a legendary economist. [laughs] I’m treading into your domain, which is a bit precarious as I’m not an economist.

COWEN: Just to clarify, I haven’t resolved this issue myself. I’m genuinely seeking insights from various experts. I asked Austan Goolsbee the same question because I’m not entirely sure.

In a recent blog post, Tyler noted:

AI serves as your most astute and empathetic reader.

This raises an interesting question: why seek opinions from various experts? Why not consult an AI? The answer lies in the fact that “smartest” can be subjective. While leading AIs excel in many areas, they may not shine in the most complex domains. I posed the same question to ChatGPT, and its response was rather underwhelming compared to the insights I’m about to share. (Consider this a playful jab. Tyler is correct that AIs outperform many of us on numerous questions—but there are fields where human expertise still reigns supreme.)

Now, onto my viewpoint: stablecoins do not inherently jeopardize monetary policy. The Federal Reserve retains control over the monetary base and possesses almost limitless capacity to influence both the supply and demand for base money. This capability enables them to counteract the emergence of money substitutes, ensuring that macroeconomic objectives—like employment levels and price stability—remain intact.

The Fed can directly manipulate the supply of base money through open market operations, involving the buying and selling of Treasury securities. This is the essential power they need to completely neutralize any influence stablecoins might have on the demand for base money. Additionally, they wield another potent tool that affects the demand for base money: interest on bank reserves. With these two instruments, the Fed can adeptly adjust the price level to their desired target. While political realities may restrict the Fed from making drastic shifts in the Consumer Price Index, this does not hinder their ability to stabilize prices in light of stablecoin adoption.

It’s worth noting that some of my perspectives on monetary policy may be contentious and not universally accepted among experts. However, I don’t consider my stance on this specific issue controversial—unless, of course, the demand for base money were to plummet to zero. Such a scenario seems improbable, particularly since stablecoins will likely require backing from some form of government currency, and cash will continue to find its way into circulation.

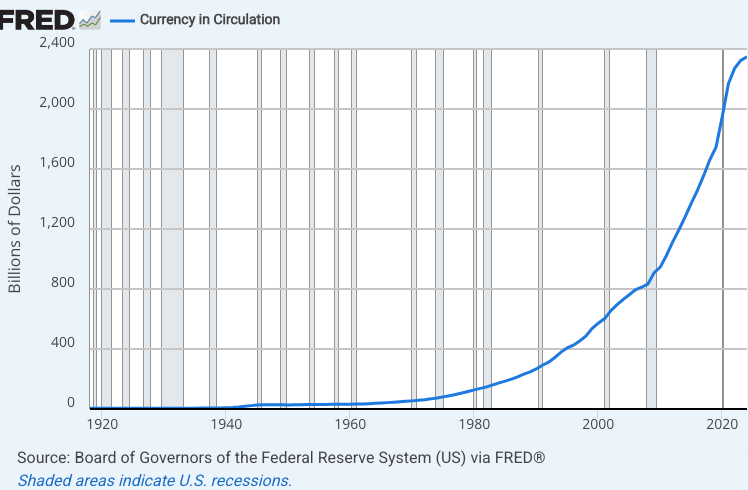

Furthermore, contrary to popular belief, the demand for physical currency has not diminished, even as we transition towards a more “cashless society.” The demand for cash, even as a proportion of GDP, is actually greater today than it was a century ago when cash transactions were the norm. This increase is primarily attributable to escalated government regulations (think the war on drugs, for instance) and heightened tax burdens, which have significantly boosted the demand for cash as a discreet store of value, outpacing the decrease in its transactional use.

While it’s conceivable that the recent slowdown in currency demand growth could be partially attributed to the rise of stablecoins, it’s more likely tied to the surge in nominal interest rates since 2022, which has raised the opportunity cost of holding cash that earns no interest as a value store.