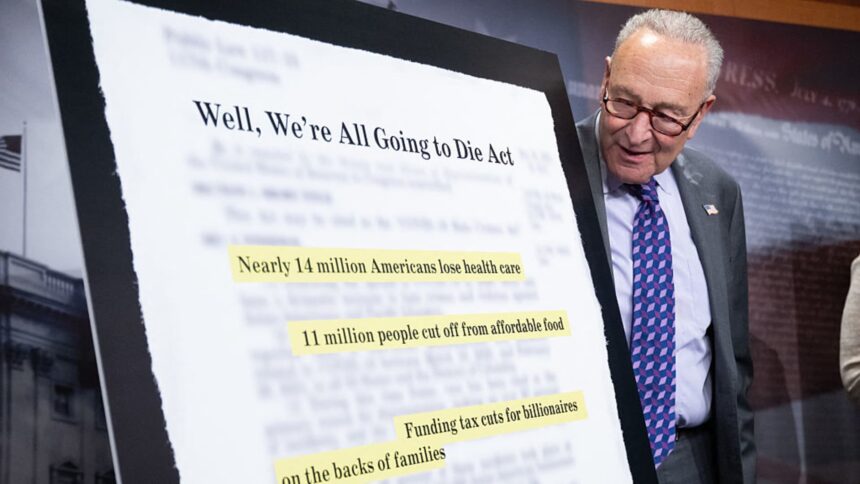

The House tax and spending bill has sparked controversy as it aims to push millions of Americans off health insurance rolls in order to fund priorities from President Donald Trump, such as nearly $4 trillion in tax cuts. The bill includes provisions that would cut programs like Medicaid and the Affordable Care Act, leading to an estimated 11 million people losing health coverage, according to the nonpartisan Congressional Budget Office.

In addition to the 11 million people projected to lose coverage under the House bill, another 4 million individuals could lose insurance due to expiring Obamacare subsidies that the bill does not extend. These cuts would result in added barriers to access, higher insurance costs, and denied benefits for certain individuals, including legal immigrants.

The legislation, known as the “One Big Beautiful Bill Act,” is currently being considered by Senate Republicans and may undergo changes as a result. Health care cuts have proven to be a contentious issue, with some GOP senators expressing reluctance to support cuts to Medicaid, which could potentially derail the bill.

According to the Congressional Budget Office, the bill would add $2.4 trillion to the national debt over a decade, despite cutting over $900 billion from health care programs during that same period. This significant reduction in health insurance availability marks a stark departure from the incremental increases in coverage that have been implemented over the past 50 years through programs like Medicare, Medicaid, and the Affordable Care Act.

Experts warn that the proposed Medicaid cuts in the bill would have far-reaching implications, affecting a wide range of populations. Allison Orris, senior fellow and director of Medicaid policy at the Center on Budget and Policy Priorities, emphasized that no population is safe from the bill’s cuts to Medicaid, which total more than $800 billion over 10 years.

One of the key provisions in the House proposal that could lead to a significant increase in the number of uninsured individuals is the implementation of new work requirements for Medicaid recipients in states that expanded Medicaid under the Affordable Care Act. These requirements would mandate that individuals between the ages of 19 and 64 demonstrate that they are working or engaging in qualifying activities for at least 80 hours per month in order to maintain their Medicaid coverage.

States would also be required to verify applicants’ eligibility and conduct regular redeterminations to ensure compliance with the work requirements. While House Speaker Mike Johnson has defended the work requirements as reasonable, the Congressional Budget Office estimates that 5.2 million adults could lose federal Medicaid coverage as a result of these provisions.

As the Senate continues to debate the bill, the fate of millions of Americans’ health insurance coverage hangs in the balance. The potential consequences of these proposed cuts underscore the importance of ongoing discussions surrounding health care policy and the need to strike a balance between fiscal responsibility and ensuring access to affordable health care for all. The proposed House legislation could have significant impacts on the healthcare landscape in the United States. According to the Congressional Budget Office (CBO), the change would potentially result in an additional 4.8 million people being without health insurance. However, this number could be even higher as there may be individuals who qualify for exemptions but fail to report their work hours or submit the necessary paperwork.

The potential consequences of this legislation extend beyond just the number of uninsured individuals. It is estimated that 10.3 million people would lose their Medicaid coverage, leading to 7.8 million of those individuals losing their health insurance altogether. This would create significant challenges for states, particularly in terms of funding for Medicaid.

Many states currently rely on health care provider taxes to generate revenue for their Medicaid programs. However, the proposed legislation would put a stop to this practice, leaving states with reduced revenue and federal support. As a result, states may be forced to make difficult decisions such as cutting coverage or other parts of their budget to maintain their Medicaid programs. For example, services like home and community-based care may face cuts to preserve funding for essential services like hospital care.

Additionally, the House proposal would delay the implementation of two Biden-era eligibility rules for Medicaid until 2035. These rules were intended to simplify the enrollment and renewal process, particularly for older adults and individuals with disabilities. Furthermore, states would see a reduction in their federal matching rate for Medicaid expenditures if they offer coverage to undocumented immigrants.

The potential impact of this legislation on the Affordable Care Act (ACA) marketplaces is also significant. More than 24 million individuals currently have health insurance through the ACA marketplaces, providing a critical source of coverage for those who do not have access to insurance through their jobs. The House legislation would likely lead to a significant reduction in ACA enrollment due to a combination of changes, rather than a single overarching proposal.

One major change proposed by the House legislation is the expiration of enhanced subsidies offered through the American Rescue Plan Act and extended through the Inflation Reduction Act. These subsidies have been instrumental in lowering premiums for households, with the typical family of four seeing a $705 reduction in their annual premiums. If these enhanced subsidies expire, an estimated 4.2 million people could be uninsured by 2034.

Overall, the proposed House legislation could have far-reaching implications for healthcare coverage in the United States. It is crucial for policymakers to carefully consider the potential impacts of these changes on individuals and states before moving forward with the legislation. The Affordable Care Act (ACA) has provided millions of Americans with access to affordable health insurance through the marketplace. However, one key aspect of the ACA is the requirement for individuals to estimate their annual income when applying for premium tax credits. If their actual income ends up being higher than their initial estimate, they are required to repay any excess subsidies during tax season.

Under current law, there is a cap on the repayment amount for many households. However, a new House bill is proposing to require all premium tax credit recipients to repay the full amount of any excess subsidies, regardless of their income. While this may seem like a reasonable requirement, experts argue that it can be unreasonable and even cruel in practice.

According to KFF, income for low-income individuals can be volatile, especially for those in hourly wage jobs, self-employed individuals, or those with multiple jobs. This makes it difficult, if not impossible, for them to accurately predict their income for the upcoming year. Requiring them to repay the full amount of excess subsidies can place a significant financial burden on already vulnerable populations.

In addition to the repayment requirements, the House bill also aims to curtail the use of marketplace insurance by certain groups of legal immigrants. Starting in 2027, many lawfully present immigrants such as refugees, asylees, and individuals with Temporary Protected Status would be ineligible for subsidized insurance on ACA exchanges. Furthermore, DACA recipients, also known as “Dreamers,” would be barred from buying insurance on ACA exchanges in all states.

Currently, DACA recipients are considered “lawfully present” for health coverage purposes in 31 states and the District of Columbia, allowing them to enroll in marketplace plans and receive subsidies. However, the proposed changes under the House bill would restrict their access to affordable health insurance.

Overall, these proposed changes to the ACA could have significant implications for individuals who rely on the marketplace for health insurance. It is important to consider the impact of these policies on vulnerable populations and ensure that access to affordable health care remains a priority for all Americans.