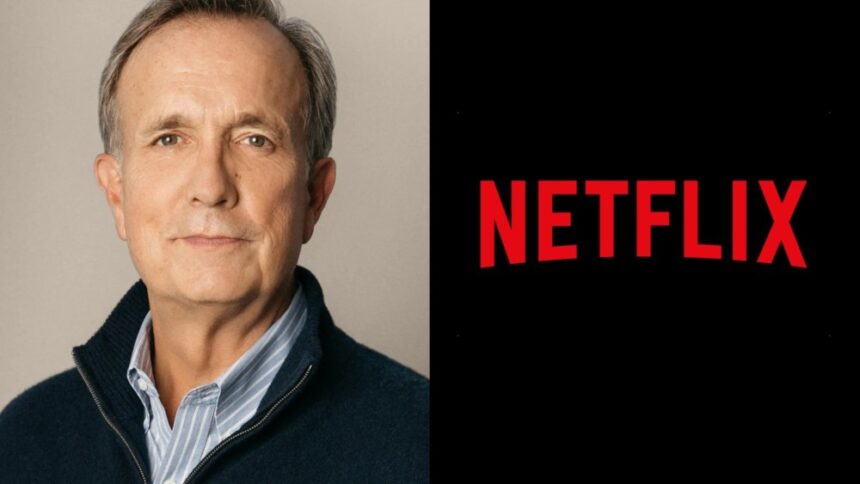

Jay Hoag, a long-standing member of Netflix’s board since 1999, faced a setback at the company’s recent annual shareholder meeting. Despite his tenure, Hoag failed to secure enough votes for re-election, with 78% of shares voting against him. As a result, Hoag offered his resignation, pending board acceptance, as disclosed in an 8-K filing by Netflix.

Following the vote results, Netflix’s nominating and governance committee will review Hoag’s resignation and make a recommendation to the board on whether to accept it or take alternative action. The board will then publicly announce its decision within 90 days of certifying the election results.

One of the primary reasons cited for the backlash against Hoag was his poor attendance record at Netflix board events. Shareholder advisory firm ISS noted that directors who attend less than 75% of board and committee meetings without a valid reason may face adverse vote recommendations. In 2024, Hoag’s attendance was only 50%, but this year it has improved to 100%.

Hoag, an early investor in Netflix, has been a director since its inception. He also holds positions on the boards of Zillow Group, TripAdvisor, and Peloton Interactive, among others. Despite his impressive background and contributions, his attendance issue seems to have swayed shareholder sentiment against him.

While Hoag’s fate remains uncertain, Netflix shareholders did re-elect 11 other board members, including co-CEOs Ted Sarandos and Greg Peters, chairman Reed Hastings, and other notable figures. The shareholders also approved the compensation packages for the senior executives, including Sarandos and Peters, signaling investor confidence in the leadership team.

It’s worth noting that not all executive compensation packages receive unanimous approval from shareholders. In a recent example, Warner Bros. Discovery shareholders voted against CEO David Zaslav’s pay package. Similarly, Netflix shareholders have previously rejected executive compensation proposals, especially during times of industry unrest, such as the Writers Guild of America strike.

In addition to the executive compensation vote, Netflix shareholders at the meeting also rejected several shareholder proposals, including calls for a climate transition plan, enhanced non-discrimination policies, and transparency on charitable contributions. These rejections indicate a divergence of opinions among shareholders on certain governance and social responsibility issues.

Overall, the outcome of the annual meeting reflects the dynamic nature of shareholder activism and corporate governance in the entertainment industry. As Netflix navigates these challenges, the board’s decision on Hoag’s resignation will be a key indicator of the company’s commitment to accountability and transparency in its leadership structure.