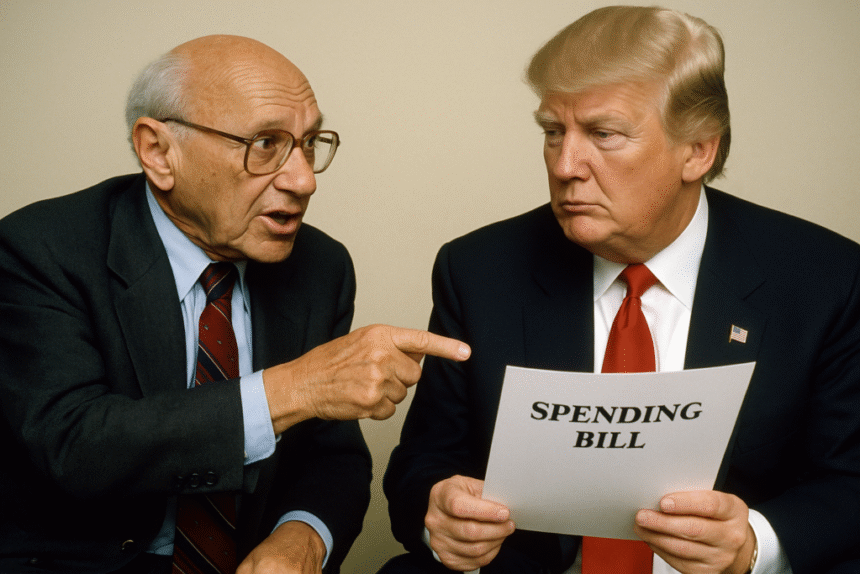

President Trump has skillfully navigated Republican critiques of his “big, beautiful [budget] bill” by asserting that a vote against it equates to endorsing “the largest tax increase” in U.S. history—an eye-watering estimated $4 trillion over the next decade. The irony here is palpable; as the late Milton Friedman cautioned decades ago, even if the 2017 tax rates remain intact, this “big, beautiful bill” will inevitably elevate the nation’s “true taxes.” How so? The bill’s significant boosts in federal deficit spending will dampen the very economic growth that Trump’s tax cuts and deregulation were designed to enhance.

Passage of the Bill Is Tenuous at Best

The Congressional prospects for Trump’s bill appear precarious at best. With Republicans holding a slim three-vote majority in the Senate, key figures like Senator Rand Paul (R-KY) and potentially two or three other deficit-conscious Senators might oppose the bill due to its additional $320 billion in federal spending this fiscal year.

Paul’s primary objection is that Trump’s budget would inflate the federal deficit for fiscal 2025 to $2.2 trillion, potentially contributing an alarming $22 trillion to the national debt over the next decade—raising it to a whopping $59 trillion by 2035 from its current $36 trillion. It’s understandable that Paul labels this deficit spending as an “existential threat” to the nation’s financial stability, fearing that Trump’s extravagant “beautiful bill” only amplifies this peril.

Compounding the bill’s chances of passage is the rift between Trump and his erstwhile budget-conscious ally, Elon Musk. Musk has denounced the bill as “pork-filled” and a “disgusting abomination.” In a fitting retort, Trump warned Paul that the “GREAT people of Kentucky will never forgive him!” should any resulting tax hikes come to pass.

Milton Friedman’s Fiscal Wisdom

It seems that both Congressional pundits and media commentators have overlooked the sage advice of Nobel Prize-winning economist Milton Friedman (1912-2006), particularly regarding policies that expand federal government powers and economic clout. Friedman’s insights have been reiterated by countless economists over the past fifty years, yet they appear to be lost on the administration’s advisors and the public at large. (For further reading, click here, here, and here.)

In plain terms, Friedman articulated in 1977 how misguided an overly extravagant budget bill is and why it could hardly “Make America Great Again.”

Friedman recognized the significance of taxes, which, alongside deficit spending, fund government operations and distribute the economic load among taxpayers. Tax-rate adjustments can influence individuals’ incentives to work, save, and invest, thereby impacting government revenues and expenditures, as well as the demand for government programs.

However, as Friedman highlighted, taxes are not the primary source of the economic cost of government. Government spending diverts resources from the private sector, similarly to taxes. Such expenditures inevitably crowd out private investments by diminishing the availability of goods and services and inflating their prices. Moreover, federal deficits incurred to finance increased spending can absorb private lending resources, elevating interest rates and subsequently hindering private investment.

Friedman wisely urged his followers to focus on what (aggregate demand-side) Keynesians of yore had often ignored: “Keep your eye on one thing and one thing only: how much government is spending. Because that’s the true tax. If you’re not paying for it in explicit taxes, you’re paying for it through inflation or borrowing.”

Concluding Comments

By proposing a budget “deal” that averts a return to 2016 tax rates while adding hundreds of billions in federal spending, Trump seems to believe he is adhering to conservative fiscal tenets, blissfully unaware that he has effectively suggested a “true tax” hike. Friedman cautioned that increased government spending could curtail personal freedoms and heighten governmental interference with private sector growth—diminishing the positive growth effects anticipated from proposed tax rate reductions and deregulation efforts embedded in this “beautiful bill.”

The takeaway from Friedman’s fiscal perspective is clear: While the administration touts its bill as a means to revitalize the economy, they have, in stark contrast to Friedman’s advice, diverted public attention from the crucial element for evaluating fiscal policy: government expenditures as a percentage of GDP. Given that Trump’s “beautiful bill” is poised to elevate federal spending to at least 24 percent of GDP by 2035—up from 23.1 percent this year (and 20.6 percent in 2019, pre-COVID)—this hardly paints a picture of how to “Make America Great Again” from Friedman’s fiscal lens.

Richard McKenzie is an economics professor emeritus at the Merage Business School at the University of California, Irvine, and the author of, most recently, Reality Is Tricky and Rationality Evolved.