Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter.

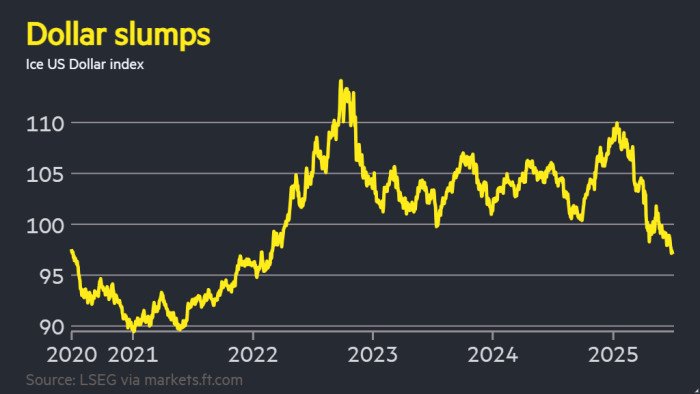

The US dollar is facing a tough time in 2025, heading for its worst first half of the year since 1973. Donald Trump’s trade and economic policies have led global investors to reconsider their exposure to the world’s dominant currency.

The dollar index, which measures the currency’s strength against a basket of six others including the pound, euro, and yen, has dropped more than 10% so far this year, marking the worst start to a year since the end of the gold-backed Bretton Woods system.

Francesco Pesole, an FX strategist at ING, commented, “The dollar has become the whipping boy of Trump 2.0’s erratic policies.” The president’s unpredictable tariff war, the US’s significant borrowing needs, and concerns about the Federal Reserve’s independence have eroded the appeal of the dollar as a safe haven for investors.

As the US Senate prepared to vote on amendments to Trump’s tax bill, the dollar weakened by 0.2% on Monday. The legislation is expected to add $3.2 trillion to the US debt over the next decade, raising worries about the sustainability of Washington’s borrowings and prompting an exodus from the US Treasury market.

The dollar’s sharp decline positions it for the worst first half of the year since a 15% loss in 1973 and the weakest performance over any six-month period since 2009.

Contrary to initial predictions, the euro has surged by 13% to over $1.17 this year, with investors focusing on growth risks in the US and seeking safe assets elsewhere, such as German bonds.

Andrew Balls, chief investment officer for global fixed income at Pimco, remarked on the impact of Trump’s policies on the dollar. He noted that while there is no imminent threat to the dollar’s status as the world’s reserve currency, a significant weakening in the currency is possible as investors hedge more of their dollar exposure, driving its value down.

Expectations of aggressive rate cuts by the Federal Reserve to support the US economy, encouraged by Trump, have also contributed to the dollar’s decline. Predictions suggest at least five quarter-point cuts by the end of next year, pushing the dollar lower.

Despite the weaker dollar benefiting US stocks, the S&P 500 continues to lag behind European counterparts due to currency effects. Large investors, from pension funds to central banks, are looking to reduce their dollar exposure, questioning whether the currency remains a safe haven.

Gold prices have soared to record highs this year, reflecting concerns about the devaluation of dollar assets. The dollar’s slump to its weakest level against rival currencies in over three years has led some analysts to anticipate a stabilization as bearish dollar bets become increasingly popular.

Guy Miller, chief market strategist at Zurich, pointed out, “A weaker dollar has become a crowded trade, and I suspect the pace of decline will slow down.”

Overall, the dollar’s struggles in 2025 underscore the impact of geopolitical and economic uncertainties on global currency markets, prompting investors to reassess their strategies in response to evolving trends.