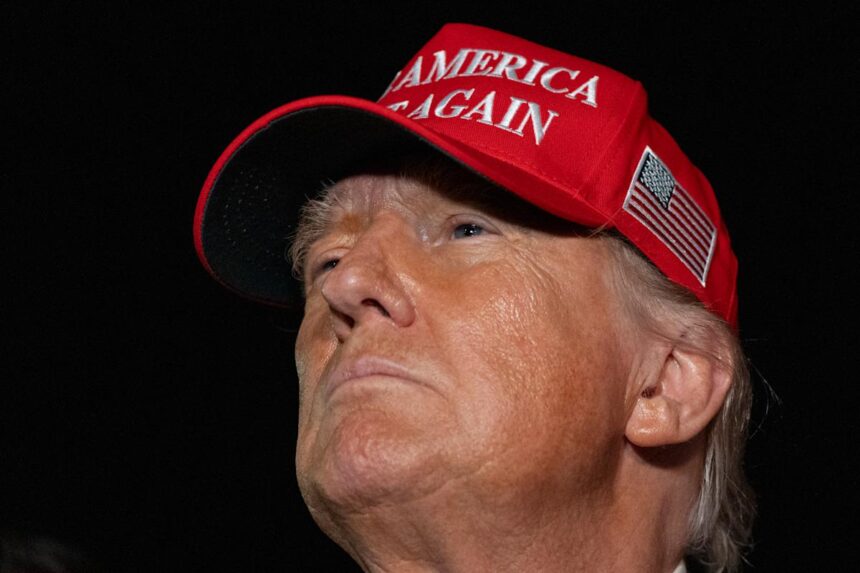

The world economy has been in a state of uncertainty for the past three months due to Donald Trump’s fluctuating tariffs. As the deadline for trade deals approaches on Wednesday, there is hope for more clarity. Trump’s 90-day reprieve from his “reciprocal” levies is coming to an end, paving the way for his protectionist policies aimed at reducing US trade deficits and boosting manufacturing.

Trump’s unilateral tariffs are disrupting a global trade system that has promoted lower barriers to commerce for decades under the supervision of the World Trade Organization. The president’s decision to impose tariffs will not only shake up trade alliances but also provide a financial boost to the US Treasury. With concerns about the nation’s debt mounting after a $3.4 trillion tax cut and spending package, additional revenue from tariffs could help alleviate some of these worries.

Treasury Secretary Scott Bessent emphasized the importance of trade in Trump’s economic agenda, which also includes tax cuts and deregulation to stimulate investment, job growth, and innovation. While the US economy has remained resilient so far with healthy hiring and low inflation, the Federal Reserve is cautious about the impact of tariffs and is closely monitoring their effects on output in the coming months.

The uncertainty surrounding Trump’s trade policies has created challenges for markets and corporate supply-chain managers as they try to navigate the potential impact on production, inventories, hiring, inflation, and consumer demand. The unpredictability of tariffs adds an extra layer of complexity to normal business planning processes.

Bloomberg Economics predicts that if reciprocal tariffs are implemented as threatened on July 9, the average duties on all US imports could soar to about 20%, significantly higher than the 3% level before Trump took office. This escalation in tariffs poses multiple risks to the US economy and could have far-reaching consequences.

In the coming week, the focus will also be on central bank decisions and key economic indicators in various regions. Australia, New Zealand, South Korea, and Malaysia are expected to make monetary policy decisions, while China’s inflation data will provide insights into manufacturing and domestic demand conditions. Additionally, the Reserve Bank of Australia is likely to cut its cash rate for the third consecutive time as inflation eases.

Overall, the global economy is facing a period of significant uncertainty and volatility as trade tensions escalate. The outcome of Trump’s trade policies and their impact on various economies will be closely watched in the days and weeks ahead.