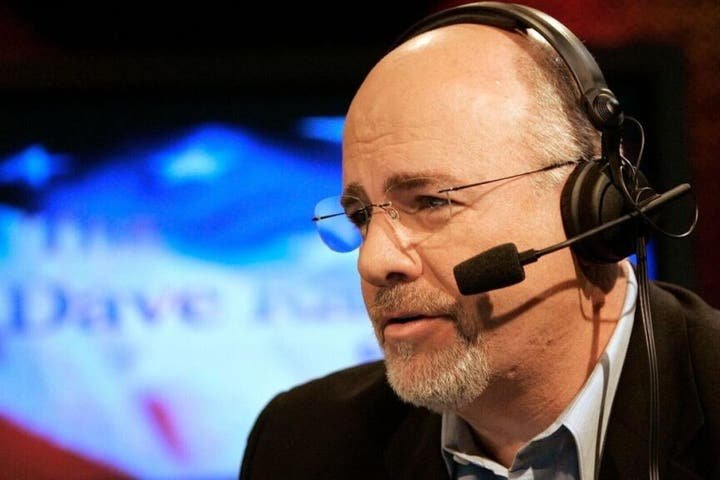

Dave Ramsey’s recent call with a long-time listener, Chad from Augusta, Georgia, has sparked a viral sensation on social media. In the video titled "This Is the Shortest Call in Ramsey Show History," Chad seeks advice on whether to pay off his mortgage or not, given his financial situation.

Chad, a real estate agent, had $211,000 in cash and a $95,000 mortgage. After 20 years of listening to Ramsey’s show, he finally mustered the courage to call in and seek guidance. His question was straightforward, but the decision he was about to make was significant.

Ramsey didn’t hesitate to give his advice. "Pay it off today," he exclaimed. The simplicity and directness of Ramsey’s response left no room for debate. Chad was seeking confirmation, and Ramsey provided it unequivocally.

The clip, which is now famous for its brevity, has garnered over 1.3 million views on YouTube. Even Ramsey’s co-host, John Delony, was unable to interject as Ramsey delivered his verdict.

While some may find Ramsey’s approach blunt, others appreciate his no-nonsense attitude towards personal finance. Ramsey’s philosophy is rooted in behavioral change rather than chasing higher returns. For him, eliminating debt is not just a financial decision but also a way to achieve emotional freedom.

Some viewers may question Chad’s decision to pay off his mortgage instead of investing the remaining money. Ramsey’s focus, however, is on the peace of mind that comes with being debt-free. He believes that financial decisions are 80% behavior and only 20% head knowledge.

The debate between paying off debt and investing for higher returns is ongoing. Ramsey’s approach may not align with everyone’s financial strategy, but his emphasis on financial discipline and freedom resonates with many.

In conclusion, Ramsey’s advice to Chad may have been predictable, but its impact on viewers is undeniable. Whether you agree with his methods or not, Ramsey’s influence in the world of personal finance is undeniable. The viral nature of this call serves as a reminder of the power of simplicity and clarity in financial decision-making.