President Trump’s recent legislation, known as the One Big Beautiful Bill, marks a significant shift in federal student loan programs, moving away from the debt-forgiveness movement that characterized the Biden era. The new law introduces strict borrowing limits, reduces repayment options, and emphasizes private lenders as alternatives. These changes, effective August 1, are expected to push students towards higher interest rates and less forgiving repayment plans.

The White House justifies these changes as a means to protect taxpayers from a growing national loan bill and to compel colleges to lower their prices, which have soared in recent decades. However, critics worry that the new policies may lead to more students dropping out of school or opting for more affordable technical career training programs.

One notable change is the capping of Parent PLUS loans at $20,000 annually and $65,000 per child, starting July 1, 2026. Similarly, Grad PLUS loans will be limited to $20,500 annually and $100,000 total for general master’s degrees. These changes mark a departure from the previous practice of federal loans covering the full cost of tuition.

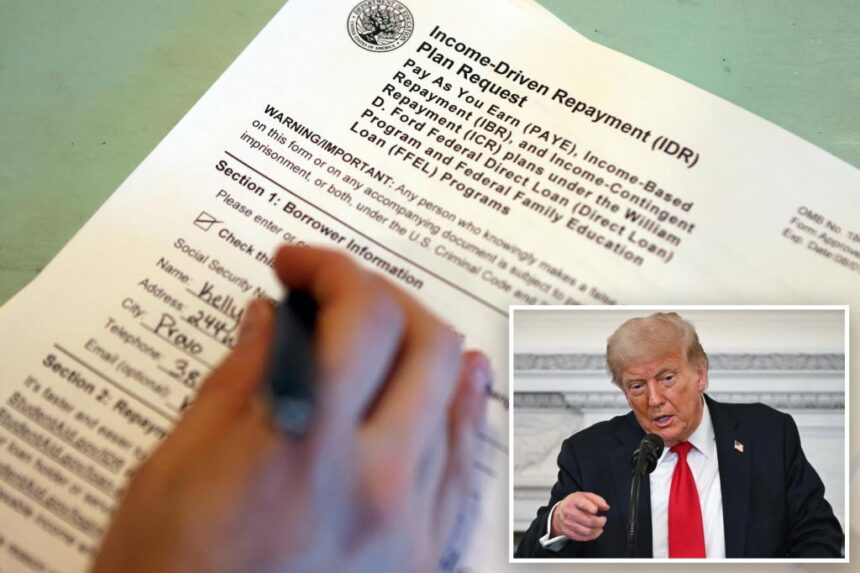

Under the new law, unemployment deferment options will be eliminated for borrowers taking out federal loans after July 2027. Additionally, the number of repayment plans will be reduced to just two options – a fixed repayment plan or an income-driven Repayment Assistance Program.

Private lenders are expected to benefit from these changes, with some already preparing to step in for the government. Higher interest rates and stricter eligibility criteria are common features of private loans. Experts anticipate a shift towards trade schools or community colleges as students seek more affordable alternatives.

The federal government’s Pell Grants program will also undergo changes, reducing eligibility for full scholarship recipients while expanding eligibility for those in workforce training programs. These adjustments reflect a broader shift towards more cost-conscious education choices.

Overall, the new legislation represents a significant departure from previous federal student loan policies, prompting students and families to explore alternative financing options and consider lower-cost education alternatives.