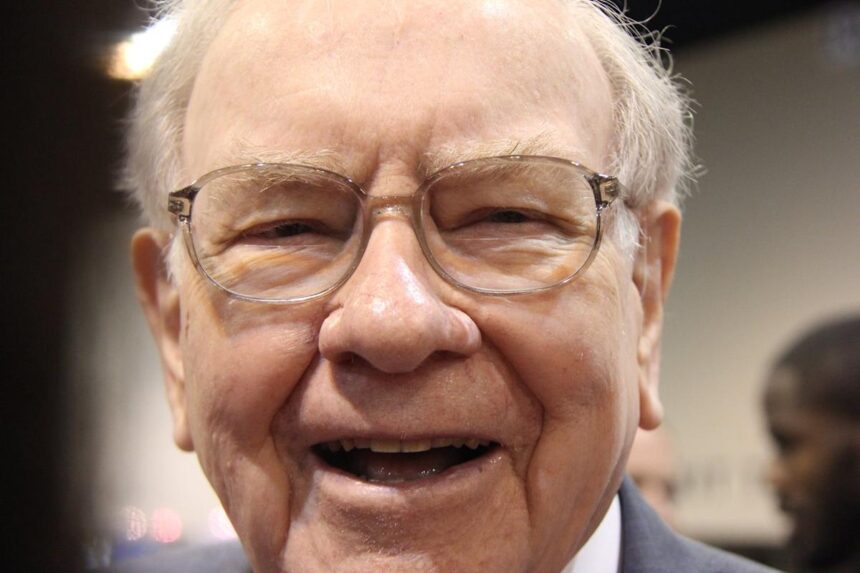

Berkshire Hathaway, led by renowned investor Warren Buffett, has recently increased its stake in SiriusXM to a whopping 37% of the company. This move comes at a time when SiriusXM’s stock has been facing downward pressure from investors who are skeptical about its future prospects. Despite this, management at SiriusXM is actively implementing cost-cutting measures and rolling out new growth initiatives to turn things around.

While Berkshire Hathaway has been selling off significant portions of its stock holdings in recent years, including in companies like Apple and Bank of America, it has continued to accumulate shares of SiriusXM. In fact, Berkshire recently purchased an additional 5 million shares of SiriusXM for around $106.5 million, bringing its total ownership to 37% of the company.

The decision to increase its stake in SiriusXM is likely due to the stock being undervalued, trading at just over 7 times forward earnings estimates. Despite some concerning trends, such as declining revenue and subscriber base, SiriusXM remains a profitable business with over $1 billion in annual free cash flow and a 5% dividend yield.

On the flip side, SiriusXM’s management is actively addressing these challenges by cutting costs and implementing new revenue-generating strategies. The company aims to achieve $200 million in cost savings by the end of the year and is exploring new opportunities to increase revenue, such as offering ad-supported free versions of its service in new vehicles.

Overall, SiriusXM is optimistic about its future growth potential, with plans to increase free cash flow by 50% and reach a new all-time high for subscribers. If successful, this could be a significant win for Warren Buffett and other shareholders of the company.

Before considering an investment in SiriusXM, it’s important to weigh the risks and rewards. While Berkshire Hathaway sees value in the company, other opportunities may offer even greater potential returns. The Motley Fool’s Stock Advisor team has identified 10 stocks they believe could outperform the market in the coming years, offering investors the chance to capitalize on significant growth opportunities.

In conclusion, Berkshire Hathaway’s increased stake in SiriusXM reflects confidence in the company’s long-term prospects despite current challenges. By staying informed and considering all investment options, investors can make well-informed decisions to achieve their financial goals.