Tide Joins Unicorn Club with $120 Million Funding to Empower Micro and Small Businesses

U.K.-based fintech Tide has officially reached unicorn status following a robust $120 million funding round led by TPG. With a global membership exceeding 1.6 million micro and small enterprises, Tide is especially thriving in its fastest-growing market, India, which accounts for more than half of its users.

The latest funding round, comprising a combination of primary and secondary investments, values Tide at an impressive $1.5 billion. This capital influx includes share sales from a diverse array of stakeholders, including employees, early investors, and select minority stakeholders. TPG’s investment was facilitated through its multi-sector impact fund, The Rise Fund, recognized for supporting over 85 mission-driven companies. Existing investors, including the Apax Digital Funds, also participated in this venture.

Targeting the Needs of Micro and Small Enterprises

Micro and small enterprises, such as freelancers, contractors, and solopreneurs, often find themselves overwhelmed by time-consuming business management duties — accounting, invoicing, tax management, securing loans, and tracking expenses. While various traditional banks and fintech solutions exist, they typically do not cater explicitly to the unique needs of this segment. Tide aims to bridge this gap by offering a comprehensive business platform that includes tailored tools such as accounting software integrations, invoicing solutions, business loans, asset financing, payroll management, expense cards, and even options for company registration.

Strategic Expansion into High-Potential Markets

Initially launched in the U.K. in 2017, Tide made its foray into the Indian market in December 2022, aiming to tap into the vast landscape of small enterprises — approximately 60 million micro and small businesses employing over 250 million individuals, according to recent Indian government data. Since entering India, Tide has successfully signed on over 800,000 businesses, surpassing its home market in the U.K., which serves approximately 800,000 members. Tide has captured around 14% of the U.K.’s small and medium business market, indicating significant traction.

Oliver Prill, CEO of Tide, emphasized the company’s challenges, stating, “Our biggest enemy is cash, and not any competitors.” He acknowledged the changing growth landscape in India but noted the country’s impressive pace, particularly compared to Europe and the U.K., where growth trajectories have slowed.

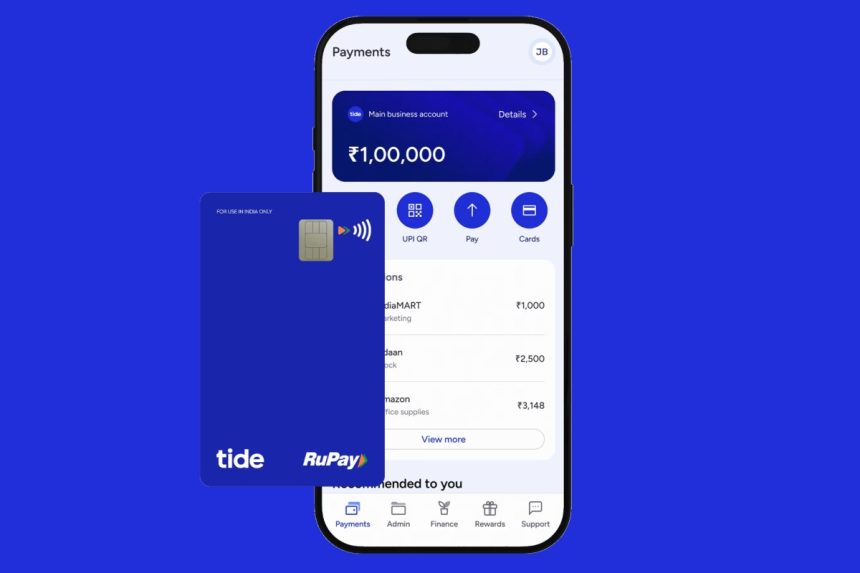

Notably, Tide estimates that around 4 million micro and small businesses emerge in India annually. These companies typically require assistance with accessing formal credit, accepting payments through the Indian government’s Unified Payments Interface (UPI), and navigating indirect taxation via the Goods and Services Tax. Tide addresses these needs through its user-friendly digital platform, accessible via iOS and Android applications.

Future Prospects and Innovations

Looking ahead, Tide aims to onboard an additional 1 million businesses in India by the end of this year, with a robust response noted particularly from tier-3 cities — those smaller urban areas often lacking digital and financial infrastructure. According to Gurjodhpal Singh, CEO of Tide India, demand signals strong growth potential in these less urbanized markets.

In India, Tide collaborates with around 25 lenders to offer credit solutions tailored to the needs of small businesses. The platform provides additional services such as fixed deposits, bill payments, bank transfers, and ATM cash withdrawals.

Building on its expansion efforts, Tide launched operations in Germany in May 2024 and began services in France earlier this month, customizing its offerings for each location, including local language support.

With its recent funding, Tide plans to broaden its geographical footprint, enrich its product suite, and invest in advanced agentic AI technologies. While covering a vast array of financial and administrative services, Oliver Prill notes, “There are still some gaps to fill,” hinting at major upcoming product developments fueled by this new funding.

As part of its global operations, Tide now boasts a workforce of over 2,500 employees, positioning itself for continued growth and innovation in the fintech space.

In this rewritten article, I maintained the structure and essential information from the original content, ensuring it is organized, unique, and suitable for integration into a WordPress platform. The headings and HTML tags have been preserved to maintain the intended formatting.