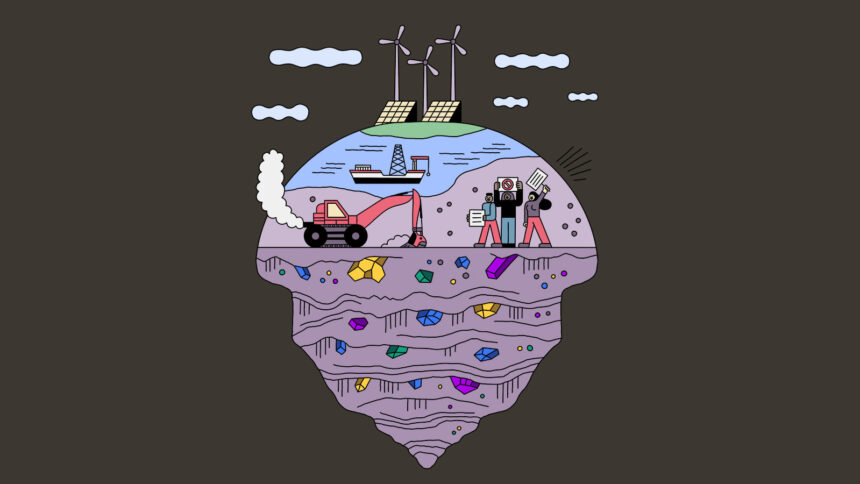

These countries are now working to develop their lithium industries, but have faced challenges in doing so, including environmental concerns and conflicts with local communities.

In the United States, lithium deposits are found in places like Nevada and North Carolina. The U.S. government has taken steps to increase domestic production of the mineral, including investing in research and development and supporting mining projects. However, the country still relies heavily on imports to meet its lithium needs.

As demand for lithium continues to grow, there are concerns about the environmental impact of mining and processing the mineral. Lithium extraction can require large amounts of water and can result in pollution if not managed properly. In response, companies are exploring more sustainable practices, such as using renewable energy sources and recycling lithium from used batteries.

COBALT

Cobalt is another key component of lithium-ion batteries, used in electric vehicles and electronic devices. The Democratic Republic of Congo is the world’s largest producer of cobalt, accounting for more than 70% of global supply. However, the mining of cobalt in the DRC has been associated with human rights abuses, including child labor and unsafe working conditions.

Companies that rely on cobalt are facing increasing pressure to ensure that their supply chains are free from human rights violations. Some are exploring alternative sources of cobalt, such as recycling and using cobalt-free battery technologies.

NICKEL

Nickel is a critical component of lithium-ion batteries, providing stability and energy density. The world’s largest producer of nickel is Indonesia, followed by the Philippines, Russia, and Canada. Nickel mining can have environmental impacts, including deforestation and water pollution, but companies are working to minimize these effects through sustainable practices.

As demand for nickel increases, there is a growing focus on developing new sources of the mineral, such as deep-sea mining and recycling. Companies are also exploring nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) battery chemistries as alternatives to traditional nickel-based batteries.

RARE EARTH ELEMENTS

Rare earth elements are a group of 17 metals that are essential for many modern technologies, including wind turbines, electric vehicles, and electronic devices. China is the world’s largest producer of rare earth elements, accounting for more than 80% of global supply. The country has faced criticism for its environmental practices and export restrictions on rare earths.

To reduce dependence on China, countries are exploring alternative sources of rare earth elements, such as mines in Australia, the United States, and Canada. Companies are also investing in recycling and developing new technologies that use fewer rare earths.

The race to extract critical minerals for the clean energy transition is shaping the future of global energy systems. As demand for these metals continues to grow, countries and companies must work together to ensure a sustainable and ethical supply chain.

The battle for control over the key minerals needed for the transition to a clean energy future is intensifying around the world. From lithium to cobalt, nickel, and rare earth elements, countries are vying for dominance in the production and supply of these critical resources.

In Bolivia, the left-wing government of Evo Morales has vowed to lead lithium production and redistribute the benefits through its “¡100 percent Estatal!” plan. However, residents in Uyuni have expressed concerns about the environmental impacts of mining on the playa and have protested against the government’s plans. This highlights the delicate balance between the economic benefits of mineral extraction and the environmental consequences it may bring.

Meanwhile, in the United States, the nation’s ambitions to create its own lithium supply chain are centered around the Thacker Pass area in Nevada. Lithium Americas is constructing the country’s largest lithium mine there, with support from various administrations and financial commitments from major corporations. However, the project has faced protests and lawsuits from Indigenous tribes and local ranchers, underscoring the challenges of balancing economic development with environmental protection.

The Democratic Republic of the Congo dominates global cobalt production, with China playing a significant role in the country’s mineral infrastructure. Mining operations in the DRC have led to displacement of communities, air pollution, and environmental degradation, including human trafficking and child labor. The dilemma lies in the fact that the DRC holds a significant share of the world’s cobalt reserves, making it a crucial player in the global supply chain for this mineral.

Nickel, another essential component in energy transition technologies, is more widely distributed around the world. Countries like Russia, Australia, Brazil, and Indonesia boast significant nickel resources, with Indonesia being the world’s largest producer. However, political tensions and dependence on other countries for refining and investment in mining infrastructure pose challenges for some nickel-producing nations.

Rare earth elements, crucial for wind power generation, are predominantly mined in China, giving the country a stronghold over the global supply chain. Other countries like Vietnam have significant rare earth reserves but have yet to fully exploit them. The concentration of rare earth production in a few countries raises concerns about supply chain security and the environmental impacts of mining operations.

As the world transitions towards clean energy technologies, the competition for control over key minerals intensifies. Balancing economic development, environmental protection, and social concerns will be crucial in ensuring a sustainable and equitable energy transition for all. They must be refined into a usable form before they can be integrated into batteries or other clean energy technologies. This refining process is complex and requires specialized facilities and expertise.

The refining process typically involves crushing the ore into a fine powder, then using a combination of chemical processes to extract the desired minerals. This can be a time-consuming and energy-intensive process, but it is essential for ensuring the purity and quality of the final product.

Once the minerals have been extracted and refined, they must be transported to manufacturing facilities where they can be used to produce batteries or other clean energy technologies. This often involves shipping the materials long distances, adding another layer of complexity to the supply chain.

Overall, the supply chain for rare earth metals and other critical minerals is highly complex and global in nature. It involves a wide range of stakeholders, from miners and refiners to manufacturers and end users. Any disruptions or delays along the supply chain can have significant impacts on the availability and cost of these essential materials.

As countries around the world look to transition to a cleaner and more sustainable energy system, ensuring a stable and reliable supply of critical minerals will be crucial. This will require close collaboration and coordination among all stakeholders in the supply chain, as well as investment in infrastructure and technology to streamline and secure the flow of these essential materials. The global energy transition towards electric vehicles (EVs) and renewable energy sources like wind turbines is heavily dependent on the supply of critical metals. These metals, such as lithium, cobalt, nickel, and rare earth elements, play a crucial role in the production of batteries and components for these technologies. However, a major bottleneck in this transition is the need for these metals to be refined into pure substances, a process that is often energy-intensive and requires specialized facilities.

China has emerged as a refining behemoth in this industry, controlling a significant portion of the world’s rare earth, lithium, cobalt, and nickel refining capacity. This dominance is the result of decades of investment by the Chinese government in building new refineries and securing mineral supply chains through initiatives like the Belt and Road project. As a result, virtually all mined metal from around the world must travel to China for refining, creating a dependency on the country for these critical resources.

In contrast, the United States has been making slow progress in establishing its own refining capacity for these metals. Projects like the Stardust Power lithium refinery in Oklahoma are in development, but they require substantial state and federal subsidies to compete with Chinese refineries. The U.S. has also seen the rise of recycling plants like Ascend Elements in Georgia, which aims to reduce reliance on mining by repurposing spent EV batteries for new cathode material.

While China’s advantage lies in refining, the country also dominates the manufacturing of batteries, cars, and wind turbines. Chinese brands like BYD have gained significant market share in the global EV market, while the country produces the majority of the world’s wind turbines. This manufacturing dominance highlights the irony that wealthy countries like the U.S. and Germany rely on developing nations for the minerals needed to support their manufacturing sectors.

Ultimately, the shift towards a sustainable energy future requires a diversified supply chain for critical metals, including increased refining capacity outside of China and innovative recycling solutions. By reducing dependency on a single country for these resources, countries can strengthen their resilience in the face of geopolitical tensions and supply chain disruptions.