Africa’s tech ecosystem is buzzing with excitement as South Africa’s TymeBank and Nigeria’s Moniepoint have both recently raised funds at valuations exceeding $1 billion, propelling them into the esteemed unicorn club. These valuations not only showcase investor confidence but also highlight the success of these fintech companies in adapting disruptive financial models tailored for mature economies to suit the needs of a region where nearly half of the population remains unbanked.

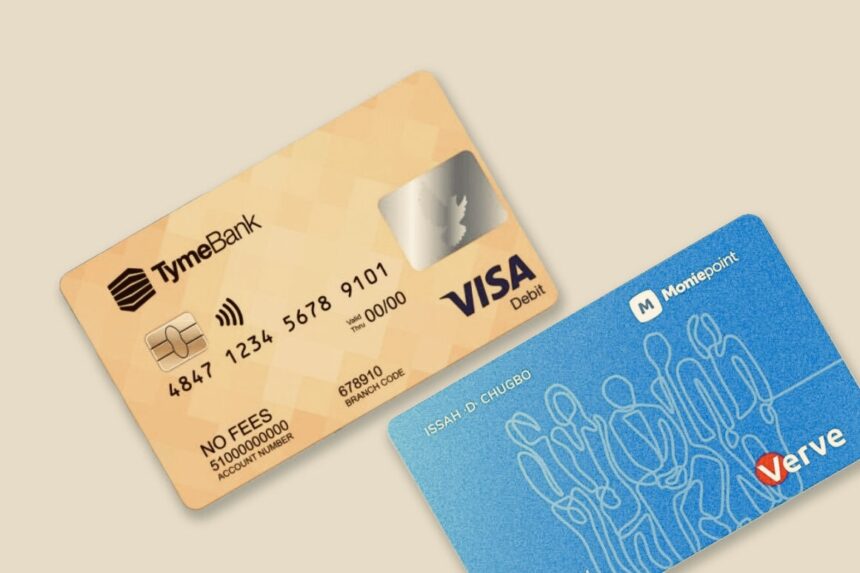

Both TymeBank and Moniepoint have focused on simplifying banking for individuals and businesses in two of Africa’s largest economies. TymeBank initially offered low-cost bank accounts and savings products to retail customers before expanding into business banking, providing working capital to small businesses in South Africa. On the other hand, Moniepoint started by supporting small businesses in Nigeria with accounts, payments, loans, and expense tools before venturing into retail banking.

A key aspect of their success lies in their hybrid approach to banking, blending the convenience of digital banking with real-world, physical touchpoints. In a region where cash is predominant, internet connectivity is unreliable, and trust in online systems is low, TymeBank and Moniepoint have strategically positioned themselves to meet the needs of both urban and rural populations.

TymeBank has established retail partnerships with supermarkets in South Africa, extending its reach through kiosks and ambassadors in stores to assist customers in opening accounts and depositing funds. This model acknowledges how the average African consumer interacts with financial services, creating a seamless banking experience. Moniepoint, on the other hand, has built an extensive network of agents nationwide, enabling cash deposits, withdrawals, and bill payments, bridging the gap between traditional banking infrastructure and underserved populations.

As these companies continue to expand their services, they are also looking to replicate their success beyond their home markets. TymeBank is eyeing expansion into Vietnam and Indonesia, while Moniepoint aims to deepen its operations in Nigeria and potentially expand into other African markets like Kenya.

The hybrid model adopted by TymeBank and Moniepoint is not exclusive to fintech and holds potential for application in various industries across Africa’s informal markets. From telemedicine to e-commerce and group insurance models, integrating local, in-person touchpoints with digital platforms can drive innovation and foster financial inclusion. This hybrid approach, balancing digital convenience with physical touchpoints, is proving to be a winning formula for startups in Africa, paving the way for sustainable growth and impact.