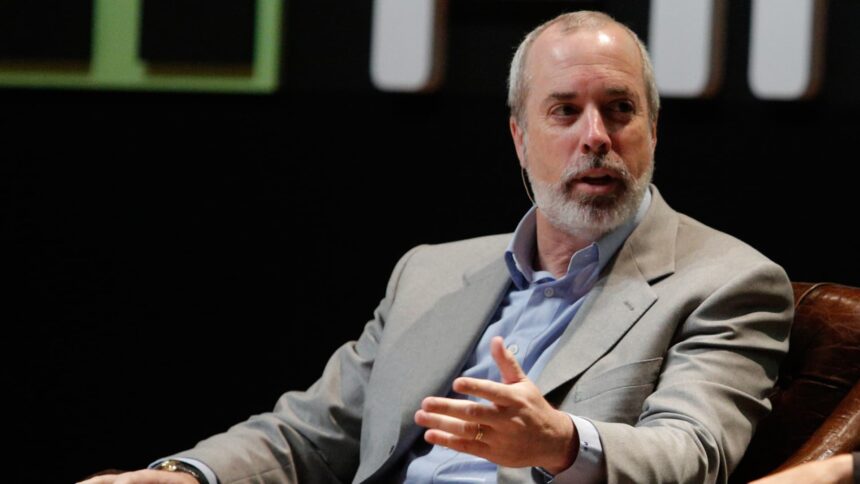

Financial literacy is a crucial skill that all Americans should strive to improve, according to renowned personal finance expert Ric Edelman. In a recent interview on CNBC’s “ETF Edge,” Edelman emphasized the importance of better educating the public on smart financial practices.

Edelman pointed out that the U.S. has historically lacked a strong tradition of promoting sound personal finance management. This deficiency has become increasingly problematic as people are living longer lives, raising concerns about financial security and retirement planning. The conventional 60-40 stock and bond portfolio may no longer be sufficient to sustain individuals through extended retirement periods.

Of particular concern to Edelman is the prevalence of get-rich-quick schemes and risky investing strategies among young investors. He criticized certain investing platforms for promoting financial gambling rather than responsible investing. The rise of options trading and zero-day options has further complicated the landscape, with retail participation in the options market reaching new heights in recent years.

Edelman cautioned against the proliferation of complex and expensive financial products that may confuse and exploit consumers. He advised young investors to seek information from credible sources and to be wary of overly sophisticated financial instruments.

A major obstacle to improving financial literacy is the lack of mandatory personal finance education in high schools. While some states have made progress in requiring personal finance courses for graduation, there is still a long way to go in ensuring that young adults are equipped with the necessary knowledge to make informed financial decisions.

Despite the challenges faced by young investors, Edelman expressed optimism about their determination to achieve financial success. Many young people are motivated by the shortcomings they see in their parents’ retirement preparedness and are eager to avoid repeating the same mistakes.

In conclusion, enhancing financial literacy is essential for individuals to navigate the complexities of personal finance and secure their financial futures. By prioritizing education and seeking out reliable information, Americans can empower themselves to make sound financial decisions and build a solid foundation for long-term prosperity.