Former Gov. Andrew Cuomo Faces Ethics Complaint Over Undisclosed Stock Options

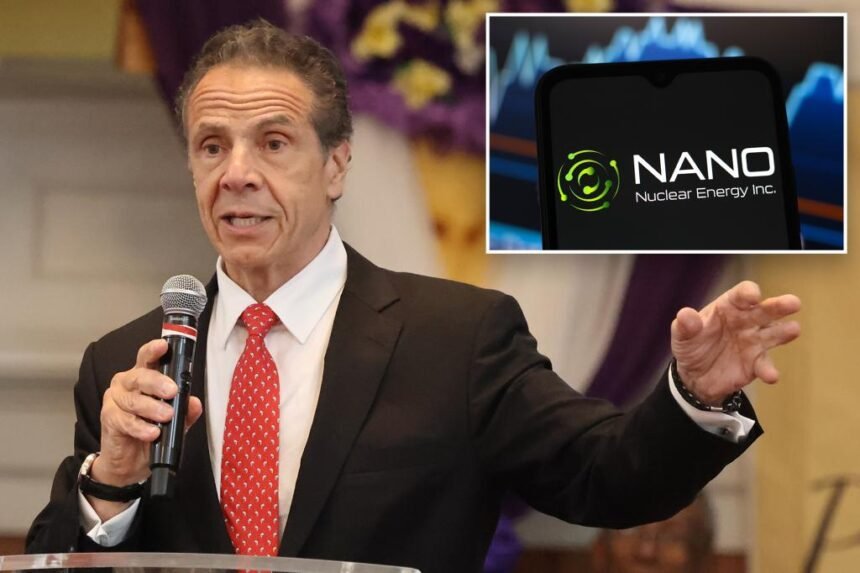

An ethics complaint has been filed against former Gov. Andrew Cuomo for not disclosing his more than $2.6 million worth of stock options in an advanced nuclear technology company before launching his mayoral campaign. The conservative watchdog group Foundation for Accountability and Civic Trust is urging the city’s Conflicts of Interest Board to investigate Cuomo for potential violations of New York City’s disclosure laws.

Cuomo’s team amended his disclosure forms to include the stock options on the same day a Politico report revealed his holdings in Nano Nuclear Energy, a publicly listed nuclear microreactor company in the US. The value of the stock options was estimated to be $2.6 million at the time of the report, but has since increased to around $4.37 million.

It was reported that Cuomo joined Nano Nuclear’s advisory board in March 2024 and his firm, Innovation Strategies, received 125,000 stock options for $3 a share. The campaign amended the filings after questions arose about the need to disclose the holdings to the COIB.

Cuomo started Innovation Strategies, a consulting firm, in April 2022 and has earned over $500,000 from it. Despite pressure to reveal the firm’s client list, Cuomo has chosen not to do so. His personal net worth is estimated to be around $3.4 million.

Andrew Cuomo is widely regarded as the frontrunner in the New York City Democratic mayoral primary. He has been associated with Nano Nuclear Energy, with the company’s founder expressing gratitude for Cuomo’s support.

Cuomo’s past actions regarding the Indian Point Energy Center and his advocacy for nuclear plant subsidies have also come under scrutiny. Despite his efforts to close Indian Point, Cuomo has supported subsidies for other nuclear plants in the state.

The Post has reached out to Nano Nuclear for comment on the matter.