Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, made headlines once again as he continued to sell off a significant portion of his stake in Apple, the conglomerate’s largest equity holding. This marked the fourth consecutive quarter in which Buffett reduced his stake in the tech giant, with the latest figures showing Berkshire Hathaway holding $69.9 billion worth of Apple shares at the end of September.

This latest move by Buffett implies that he offloaded approximately a quarter of his stake in Apple, leaving the conglomerate with around 300 million shares in the company. Overall, the stake has decreased by 67.2% compared to the end of the third quarter last year. Buffett initially started trimming his stake in Apple in the fourth quarter of 2023, with the selling intensifying in the second quarter when he surprisingly dumped nearly half of the bet.

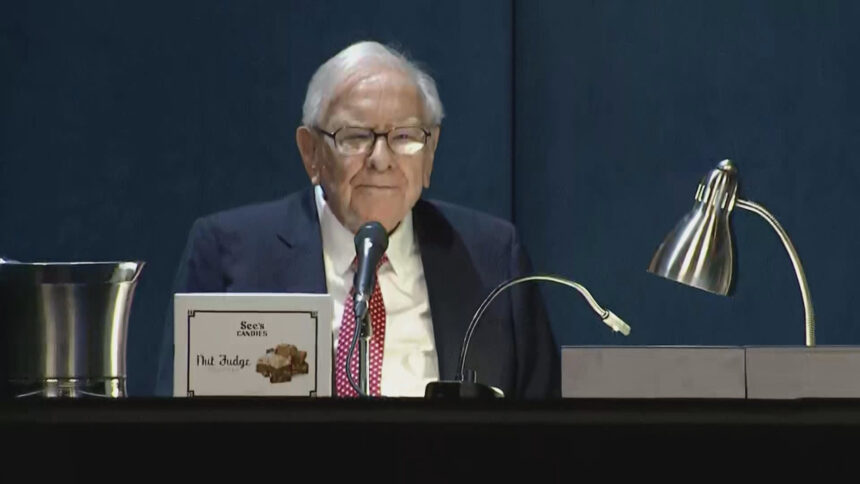

The decision to sell off a substantial portion of Berkshire Hathaway’s Apple stake has sparked speculation among analysts and shareholders. Some believe that the move may be driven by concerns over high valuations and a desire to reduce portfolio concentration. At the Berkshire annual meeting in May, Buffett hinted that the selling could also be motivated by potential changes in capital gains tax rates, as he speculated that the U.S. government might raise taxes to address a growing fiscal deficit.

Berkshire Hathaway first started buying Apple stock in 2016 under the guidance of Buffett’s investing lieutenants, Ted Weschler and Todd Combs. Prior to this investment, Buffett had largely steered clear of technology companies, citing them as outside his circle of competence. However, Buffett was drawn to Apple for its loyal customer base and the enduring popularity of the iPhone. Over time, Apple became Berkshire’s largest holding, with Buffett even dubbing it the second-most important business in the conglomerate’s portfolio.

Despite the ongoing sell-off of Apple shares, Berkshire Hathaway’s cash reserves reached an all-time high of $325.2 billion in the third quarter. The firm also paused its buyback program during this period. Meanwhile, Apple’s stock has seen a modest 16% increase so far this year, lagging behind the broader market’s 20% gain.

In conclusion, Warren Buffett’s decision to reduce Berkshire Hathaway’s stake in Apple reflects a strategic shift in the conglomerate’s investment portfolio. While the exact reasons behind the continuous selling remain unclear, Buffett’s actions have captured the attention of investors and analysts alike. As Berkshire Hathaway navigates the evolving market landscape, the impact of these decisions on the company’s long-term growth and profitability will be closely monitored.