Warren Buffett’s Berkshire Hathaway announced on Saturday that it had taken a $3.76 billion write-down on its stake in Kraft Heinz during the second quarter, admitting that the investment has not been successful.

Berkshire also reported a 4% decline in quarterly operating profit due to lower insurance underwriting premiums. The write-down and reduced gains from common stocks led to a 59% drop in overall net income. Buffett’s conglomerate remains cautious about market valuations, given uncertainties surrounding tariffs and economic growth.

The company disclosed a nearly record-breaking $344.1 billion cash stake and revealed that it had sold more stocks than it bought for the 11th consecutive quarter. As of mid-July, Berkshire had not repurchased any of its own stock since May 2024.

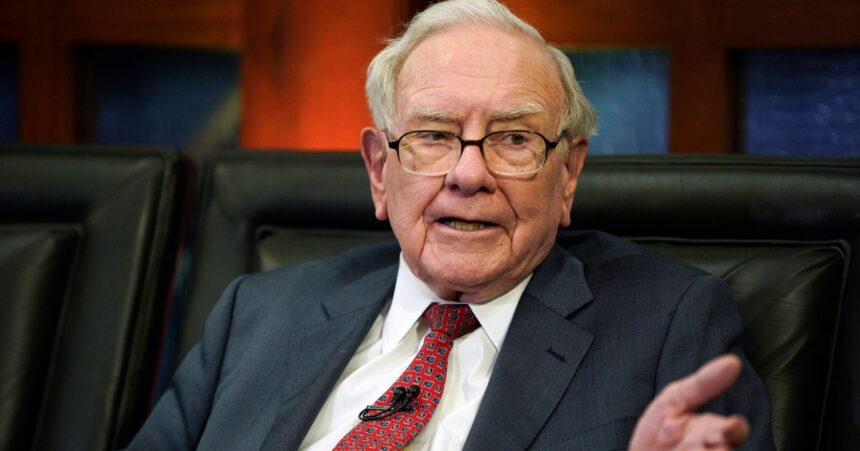

At 94 years old, Buffett has been leading Berkshire since 1965, with plans to step down at the end of the year.

Analyst Kyle Sanders from Edward Jones commented, “Investors are becoming restless and looking for opportunities, but nothing significant is happening. Buffett perceives the market as overvalued and is patiently waiting for opportunities to present themselves.”

Concerns about trade policies, particularly tariffs, have impacted Berkshire’s consumer businesses, resulting in declining revenue for most of them.

One of Berkshire’s investments, Jazwares, experienced a 38.5% revenue decline in the first half of the year.

Overall, analysts viewed the company’s results as lackluster.

Cathy Seifert and Kyle Sanders both rated Berkshire as a “hold.”

KRAFT HEINZ

In the second quarter, operating income dropped to $11.16 billion, or approximately $7,760 per Class A share, from $11.6 billion in the previous year. The results included $877 million in currency losses due to the weakening U.S. dollar.

Net income, which included gains and losses on stocks like Apple and American Express, fell to $12.37 billion from $30.35 billion. Revenue also decreased by 1% to $92.52 billion.

Buffett considers unrealized investment gains and losses, especially on stocks Berkshire does not intend to sell, as often irrelevant to understanding the company. The $3.76 billion after-tax write-down for Berkshire’s 27.4% Kraft Heinz stake, equivalent to $5 billion before taxes, followed Kraft Heinz’s announcement of exploring strategic alternatives, including a possible breakup.

Berkshire had previously valued Kraft Heinz above market value on its books but cited economic uncertainties and its long-term investment plans as reasons for the write-down being “other-than-temporary.” This is the second write-down for Kraft Heinz, following a $3 billion write-down in 2019. Buffett had admitted back then that Berkshire had overpaid in the 2015 merger of Kraft Foods and H.J. Heinz, marking one of his significant investment mistakes.

Kraft Heinz has struggled as consumers increasingly choose healthier and private-label options over its approximately 200 brands, which include Oscar Mayer, Kool-Aid, Velveeta, and Jell-O.

Berkshire also holds another substantial investment, a 28.1% stake in Occidental Petroleum valued $5.3 billion above fair value, without any need for a write-down.

LAGGING THE MARKET

Since Buffett’s announcement on May 3 that he would step down as chief executive by year-end, Berkshire’s shares have fallen over 12% and underperformed the S&P 500 by approximately 22 percentage points. The presence of Buffett, a renowned investor, in the stock price has diminished, while growth in the insurance sector, a key profit center for Berkshire, may slow down.

The lack of new investments has also impacted the company negatively. Analysts believe Berkshire’s BNSF unit could potentially acquire CSX to create another transcontinental railroad, following Union Pacific’s agreement to buy Norfolk Southern on July 29.

Over six decades, Buffett transformed Berkshire from a troubled textile company into a $1.02 trillion conglomerate.

Berkshire’s portfolio includes insurers, electric utilities, renewable energy businesses, chemical and industrial companies, and well-known consumer brands like Dairy Queen, Fruit of the Loom, and See’s Candies.

BIG BEAUTIFUL BILL

Berkshire reported a 12% decline in insurance underwriting profit in the quarter, primarily due to reinsurance and some smaller insurance businesses. Geico, its prominent insurance entity, saw a 2% increase in pre-tax underwriting profit, driven by a 5% rise in premiums offsetting a slight increase in accident losses.

Geico has been losing market share to State Farm and Progressive while focusing on enhancing underwriting quality, technology, and workforce reduction. Analysts cautioned that higher tariffs could pose a challenge for Geico if auto parts costs rise, potentially increasing accident claim losses.

BNSF has been reducing expenses, with lower fuel costs contributing to a 19% profit increase in the quarter, despite minimal changes in revenue and cargo volumes.

Berkshire Hathaway Energy achieved a 7% profit growth, with Berkshire evaluating the impact of the One Big Beautiful Bill Act signed by President Donald Trump last month on its renewable energy, storage, and technology-neutral projects.