Biosimilars are gaining traction as cost-effective alternatives to branded reference drugs in the United States. These products offer clinically effective treatment options at a lower cost, providing patients with more affordable choices for their healthcare needs. However, the road to widespread adoption of biosimilars in the U.S. is not without its challenges.

One of the primary obstacles facing biosimilars in the American healthcare system is the prevalence of patent litigation battles. Unlike in Europe, where patent disputes are less common, the U.S. sees prolonged legal battles between originator biologic manufacturers and biosimilar companies. These disputes often delay the launch of biosimilars even after they have received FDA approval.

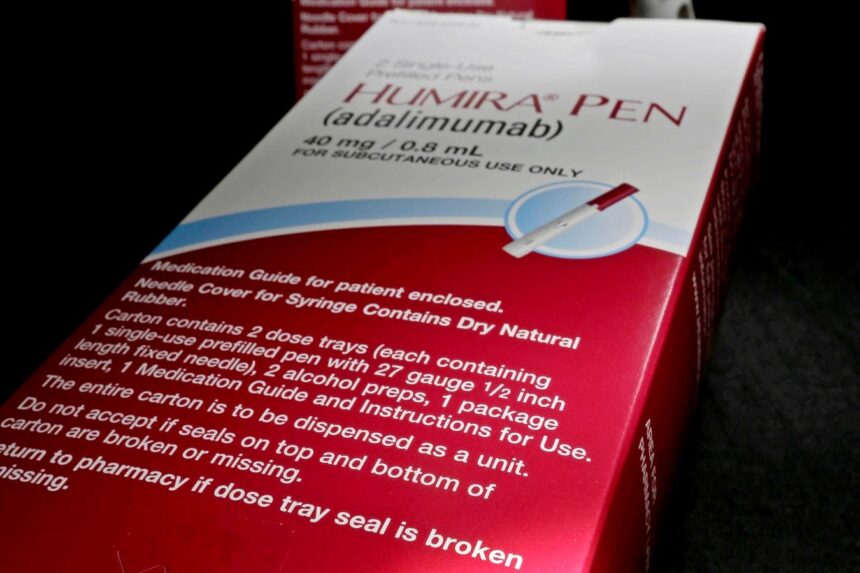

For example, several biosimilars referencing the autoimmune disease treatment Humira were approved in the U.S. in the mid to late 2010s but were unable to launch due to ongoing patent litigation. The parties involved in these lawsuits agreed to delay the launch of approved products until 2023. In contrast, Humira-referenced biosimilars entered the European market soon after the drug’s patent expiration, resulting in significant price reductions and cost savings for patients.

The situation with biosimilar competition is further complicated by dynamics in the payer and pharmacy benefit manager space. In some cases, pharmacy benefit managers may favor certain biosimilars over others, potentially limiting patient access to lower-priced options. This selective formulary management can hinder the uptake of biosimilars in the market.

Despite these challenges, biosimilars have shown promise in capturing market share, particularly in the physician-administered biologics space. For instance, biosimilars referencing blockbuster drugs like Neupogen, Herceptin, and Avastin have gained significant market share in recent years. However, the path to widespread adoption of biosimilars in the U.S. still faces hurdles related to patent disputes and market dynamics.

In Europe, where biosimilars have seen more rapid uptake, the average market share of biosimilar products has already reached substantial levels for certain reference biologics. For example, biosimilar penetration for the arthritis drug Enbrel in Germany was as high as 61% in 2019, three years after the launch of the first Enbrel-referenced biosimilar. This rapid adoption of biosimilars in Europe highlights the potential for these cost-effective alternatives to drive significant savings in healthcare costs.

Overall, while biosimilars offer a promising solution to high drug prices in the U.S., challenges such as patent litigation and market dynamics continue to hinder their widespread adoption. As policymakers and healthcare stakeholders work to address these barriers, patients stand to benefit from increased access to affordable and effective treatment options in the future.

Roche Herceptin Biosimilar Sales Drop by 50% in Europe

Within approximately one year of their launch in Europe in 2017, sales of the originator Roche Herceptin biosimilars have dropped by 50%. This significant decrease in sales has raised concerns within the pharmaceutical industry.

One of the main reasons for the decline in sales is the lack of patent reforms in certain regions. In the United States, delays in biosimilar launches are expected to continue without necessary changes. To address these issues, the Federal Trade Commission is expanding patent listing challenges and Congress is introducing legislation to promote competition and lower prices in the biosimilar market.

It is crucial for policymakers to take action to encourage competition in the biosimilar market. By implementing patent reforms and introducing legislation to address delays in biosimilar launches, it is possible to improve access to affordable biologic medicines for patients.