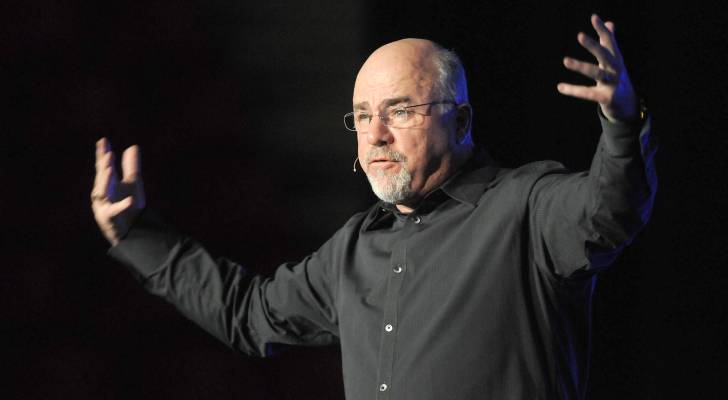

Dave Ramsey, a well-known financial guru, has recently stirred up controversy with his advice on mortgages that many are deeming out of touch with the current economic climate. In a recent episode of his popular show, Ramsey advised listeners to never take out a mortgage of more than 15 years, claiming that longer terms would cost them thousands of dollars more in the long run. However, critics argue that Ramsey’s advice fails to consider the harsh reality of the housing market today.

A recent breakdown by the @FinancialPhysics X account highlighted the challenges faced by homebuyers in the U.S. According to the video, the average home price in America is a staggering $367,711, making it difficult for many to afford a home with a shorter mortgage term. In states like Mississippi, where home prices are lower, earning $95,000 per year would be necessary to afford a 15-year mortgage.

Critics of Ramsey’s advice have flooded social media platforms with caustic comments, describing the backlash as “an absolute bloodbath.” Many argue that Ramsey’s suggestions are unrealistic, especially in the face of inflation and stagnant wages. With the median price of a home having increased by 220% in the last thirty years, aspiring homeowners are finding it increasingly challenging to enter the market.

While Ramsey’s advice on opting for a shorter mortgage term to save on interest may hold merit, it may not be practical for many potential buyers. Affording the higher monthly payments of a 15-year mortgage could strain budgets already stretched thin by rising living costs. Additionally, the new reality of homeownership has been criticized for its impact on birth rates and overall quality of life.

Despite the debate surrounding Ramsey’s advice, some supporters argue that first-time homebuyers should aim for homes below the median price in the market. They suggest that the true cost of a mortgage should factor in not only monthly payments but also insurance, maintenance, and other homeownership fees.

Ultimately, whether to opt for a 15-year mortgage or a longer term depends on individual circumstances and financial goals. Consulting with a financial advisor can help prospective buyers navigate the complexities of the housing market and make informed decisions about their mortgage. No matter the choice, careful consideration of the true cost and potential future scenarios is crucial in securing a home loan that aligns with one’s financial objectives.