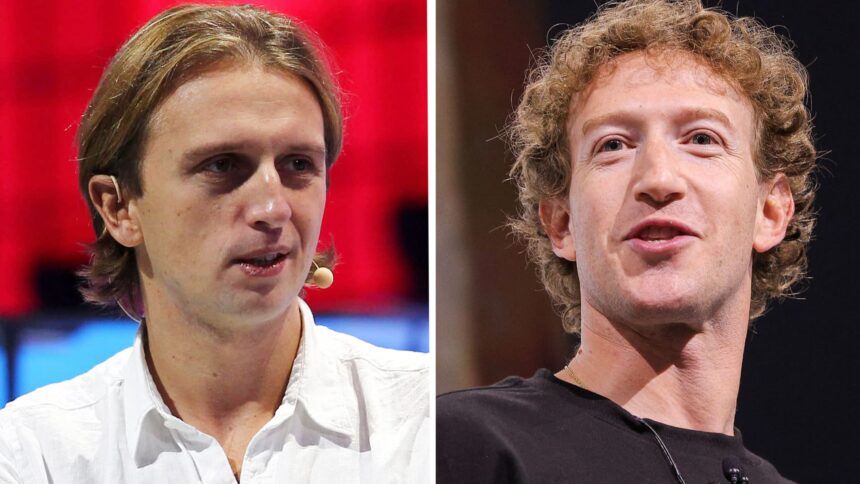

Revolut CEO, Nikolay Storonsky, recently criticized Meta, the parent company of Facebook, over its handling of fraud on its social media platforms. In a statement, Revolut expressed disappointment in Meta’s approach to compensating victims of scams, stating that the tech giant should directly reimburse those affected by fraudulent activity.

Meta had announced a partnership with UK banks NatWest and Metro Bank to share data in an effort to prevent fraud, but Revolut believes that this collaboration is insufficient in addressing the global issue of financial fraud. Woody Malouf, Revolut’s head of financial crime, emphasized that Meta’s actions are merely “baby steps” when what is truly needed are significant advancements in combating fraud.

Malouf highlighted the lack of accountability on platforms like Facebook and the absence of incentives for them to take proactive measures in preventing fraud. While data sharing among financial institutions is important, Revolut believes that more substantial actions, such as direct compensation to victims, are necessary.

In response, a spokesperson from Meta stated that the intelligence-sharing framework with banks is intended to enhance collaboration in protecting users from fraud. The spokesperson emphasized the importance of a collective effort in addressing fraud across various sectors, encouraging banks, including Revolut, to participate in this initiative.

In the UK, new payment industry regulations will soon require banks and payment firms to compensate victims of authorized push payment (APP) fraud up to £85,000. Despite initial recommendations for higher compensation amounts, the Payments System Regulator adjusted the maximum limit following opposition from financial institutions.

Revolut commended the UK government’s efforts to combat fraud but stressed the need for social media platforms like Meta to play a more active role in compensating victims of fraud originating from their platforms. According to a report released by Revolut, a significant portion of fraud reported by users on its platform was linked to Meta, with Facebook being the primary source of scams accounting for 39% of reported incidents.

As the fight against financial fraud continues, Revolut urges for greater accountability and responsibility from all stakeholders, including social media platforms, in protecting users from fraudulent activities. The company remains committed to working with regulatory bodies and industry partners to enhance security measures and safeguard the financial well-being of its users.