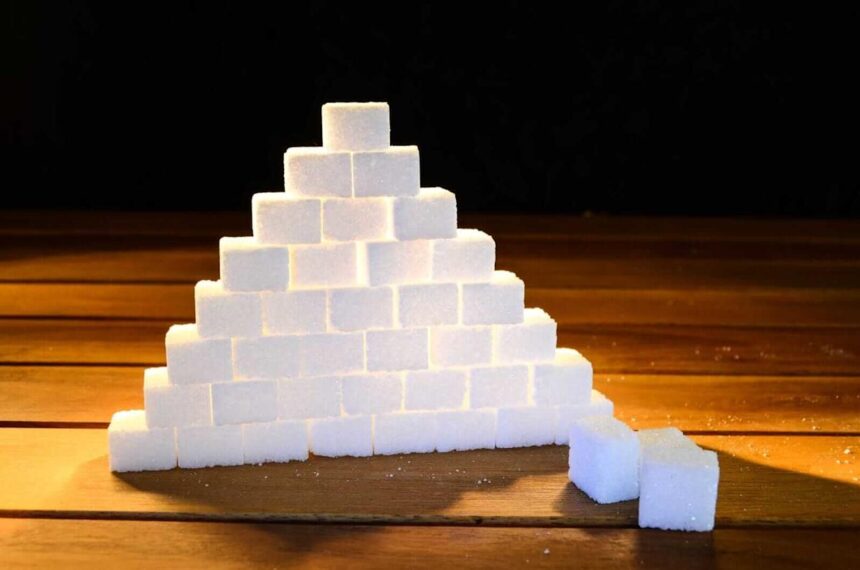

Sugar prices saw a slight uptick on Wednesday, with March NY world sugar #11 (SBH26) closing up by +0.24 (+1.64%) and March London ICE white sugar #5 (SWH26) closing up by +7.30 (+1.74%). This increase was attributed to dollar weakness (DXY00), which prompted some short-covering in sugar futures.

However, the overall trend for sugar prices has been bearish in recent weeks. Production in major sugar-producing countries like India and Brazil has ramped up, leading to an oversupply in the market. The India Sugar Mill Association (ISMA) reported a significant jump in Indian sugar production, with a +43% increase year-over-year to 4.11 million metric tons from Oct-Nov. This surge in production has been driven by a higher number of sugar mills in operation compared to the previous year.

Similarly, Brazil’s sugar output is also on the rise, with Conab raising its production estimate for the 2025/26 season to 45 million metric tons. This increase in production has resulted in a surplus, as reported by the International Sugar Organization (ISO), which forecasted a 1.625 million metric ton surplus for 2025-26.

The outlook for global sugar supplies remains robust, with Czarnikow projecting a surplus of 8.7 million metric tons for the 2025/26 season. This surplus is largely attributed to increased production in countries like India, Thailand, and Pakistan.

In India, the second-largest sugar producer in the world, the ISMA raised its production estimate to 31 million metric tons for 2025/26, up +18.8% year-over-year. This increase in production, coupled with a reduction in sugar used for ethanol production, may lead to higher sugar exports from India.

On the export front, India’s food ministry announced plans to allow mills to export 1.5 million metric tons of sugar in the 2025/26 season, lower than earlier estimates. This move, along with the anticipation of a bumper sugar crop due to favorable monsoon rains, is expected to further weigh down on sugar prices.

In Thailand, the third-largest sugar producer in the world, sugar production is also on the rise. The Thai Sugar Millers Corp projected a +5% year-over-year increase in sugar crop for the 2025/26 season.

Overall, the global sugar market is facing an oversupply situation, with record production levels expected in key producing countries. This surplus is likely to keep sugar prices under pressure in the near term, despite occasional short-covering rallies driven by external factors like dollar weakness.