Unlock the White House Watch newsletter for free

Are you interested in staying informed about what Trump’s second term means for Washington, business, and the world? Look no further than the White House Watch newsletter. With exclusive insights and analysis, this newsletter provides a comprehensive guide to the latest developments in politics and economics.

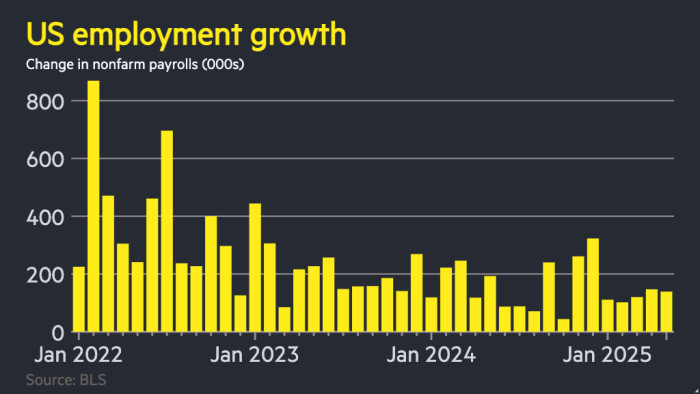

In recent news, Donald Trump has ramped up his criticism of Jay Powell, urging the US Federal Reserve chair to cut interest rates by a “full point” following a report of weakening job growth. According to data released by the Bureau of Labor Statistics, the US economy added 139,000 jobs in May, slightly below expectations. Trump took to his Truth Social platform to express his frustration, labeling Powell as “Too Late” at the Fed and calling for aggressive rate cuts.

The ongoing trade war and tariff policies implemented by Trump have put pressure on the Federal Reserve to consider rate cuts. Despite Trump’s calls for lower rates, Powell has maintained a cautious approach, emphasizing that policy decisions will be data-dependent. The recent meeting between Trump and Powell did little to ease tensions, with Trump accusing the Fed chair of “costing our Country a fortune” with high borrowing costs.

While the May job report exceeded market expectations, economists caution that revisions to previous data indicate a slowing job market. With global economic growth at risk due to trade tensions, the outlook remains uncertain. The Organization for Economic Cooperation and Development (OECD) has warned of a slowdown in the global economy as a result of Trump’s trade policies.

Average hourly earnings saw a modest increase in May, boosting consumer spending power. Despite the positive economic indicators, Treasury yields rose as traders adjusted their expectations for future rate cuts. The S&P 500 responded positively to the news, rising in morning trading.

The job market has been impacted by government job cuts under the Department of Government Efficiency, led by Elon Musk until his recent departure. Musk’s critique of Trump’s tax policies and cost-cutting measures have led to a reduction in federal government jobs. However, the leisure and hospitality sectors have seen an uptick in hiring, offsetting some of the losses.

Overall, the economic landscape remains uncertain as Trump’s policies continue to influence market dynamics. Stay informed with the White House Watch newsletter for in-depth analysis and expert commentary on the latest developments. Subscribe now to unlock exclusive content and stay ahead of the curve.