Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter.

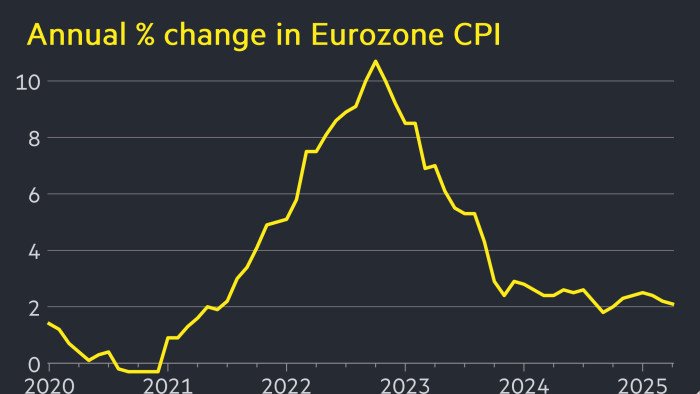

Eurozone inflation remained at 2.2 per cent in April, surpassing expectations and complicating the European Central Bank’s task as it considers whether to cut interest rates further at its next meeting in June.

Economists had predicted that the figure would fall to 2.1 per cent, according to a poll by Reuters.

The euro was flat at $1.133 immediately after the data, up 0.3 per cent on the day, as investors continued to bet on rate cuts.

“The ECB will probably look through this surprise,” said Tomasz Wieladek, economist at T Rowe Price, emphasizing that the central bank was increasing its focus on economic activity in the Eurozone, which recent surveys have indicated is weak.

“Much lower oil prices and a stronger euro still have yet to fully feed through to inflation,” he added.

Friday’s figure marks the sixth month in a row that inflation in the single currency bloc has been above the ECB’s target of 2 per cent.

Annual core inflation, which excludes highly volatile prices for energy and food, rose to 2.7 per cent, surpassing both the previous month’s pace of 2.4 per cent and economists’ expectations of a 2.5 per cent rate.

Services inflation — a closely watched metric that the ECB regards as an important gauge of domestic price pressure — increased to 3.9 per cent year over year, after falling to 3.5 per cent in March.

Analysts at Capital Economics said the services inflation rise was “unlikely to worry ECB officials too much as it was probably driven mainly by Easter timing effects” and was “unlikely to stand in the way” of further cuts.

Economists argue that the year-on-year comparison is distorted by the fact that the Easter holidays — a time when services in hotels, restaurants, and other areas tend to rise because of a rise in travel — were in April this year but in March last year.

Traders gave an 85 per cent chance of a quarter-point cut at the ECB’s June meeting, according to levels implied by swaps markets, largely unchanged from before the release. Overall, two or three such cuts are expected by the end of the year.

Short-term Eurozone government bonds, which are sensitive to changes in interest rate expectations, were also steady after the data release, with the two-year German Bund yield up 0.04 percentage points on the day at 1.74 per cent.

The ECB began lowering rates last summer after battling to tame an unprecedented surge in consumer prices during the coronavirus pandemic when inflation peaked at 10.6 per cent.

ECB rate-setters voted unanimously last month to cut rates by a quarter point to 2.25 per cent, citing concerns over growth amid “rising trade tensions” from US President Donald Trump’s aggressive tariff agenda.

Christine Lagarde, ECB president, added that “most measures of underlying inflation” suggested that the central bank was on track to meet its target “on a sustained basis”.

While the Eurozone economy performed better than expected in the first three months of the year, with growth of 0.4 per cent, the announcement of Trump’s so-called “reciprocal duties” has since dented the outlook for the region.

“The ECB has indicated it is not as concerned about inflation as it is on growth due to the tariff impact,” said Francesco Pesole, FX strategist at ING. In other circumstances, investors would expect a hawkish shift from the central bank, he added.