“Consolidation is inevitable, and those who embrace it early will reap the benefits of increased efficiency, visibility, and security.”

The rise of SASE as a consolidator of enterprise security tech stacks is evident in the recent $359 million Series G funding round for Cato Networks. This investment signals a strong belief from investors that SASE will drive significant consolidation in the security market. With a valuation of $4.8 billion and a 46% YoY growth in ARR for 2024, Cato is poised to lead the charge in advancing AI-driven security and innovation across various domains.

Gartner’s projection of the SASE market reaching $28.5 billion by 2028 further solidifies the trend towards consolidation. Organizations are favoring a dual-vendor approach, indicating a shift towards unified platforms that offer simplicity and efficiency. The parallels between SASE and cloud computing in consolidating disparate solutions into cohesive platforms are clear, signaling a new era in cybersecurity.

Consolidation has long been a growth strategy in cybersecurity, with platforms like CNAPP and XDR leveraging this approach successfully. CISOs are increasingly looking to reduce complexity and streamline their tech stacks to improve security and operational efficiency. Legacy technology stacks often present challenges in managing networks and security simultaneously, leading to high costs and maintenance overheads.

The impact of consolidations on security operations is undeniable, with complexity and tool sprawl hindering organizations from achieving optimal security posture. Consolidating cybersecurity products not only reduces complexity but also enhances overall efficiency by streamlining operations and improving visibility.

Timing is crucial when capitalizing on consolidation, as adversaries often exploit legacy vulnerabilities to breach networks. Multivendor security architectures can introduce gaps that go unnoticed until a security incident occurs. By closing these gaps in infrastructure, cloud, and network security, organizations can strengthen their security posture and adapt to evolving threats.

CISOs are recognizing the value of SASE as a consolidation strategy, with many organizations adopting SASE to unify SD-WAN and security into a single platform. The shift towards vendor consolidation reflects a growing trend in the industry, driven by the need for improved threat detection and response capabilities.

The convergence of networking and security functions in SASE is driving a fundamental architectural transformation in the security landscape. By combining critical security capabilities like SWG, CASB, and ZTNA with SD-WAN, SASE offers a unified platform to enforce security policies and protect data across diverse environments.

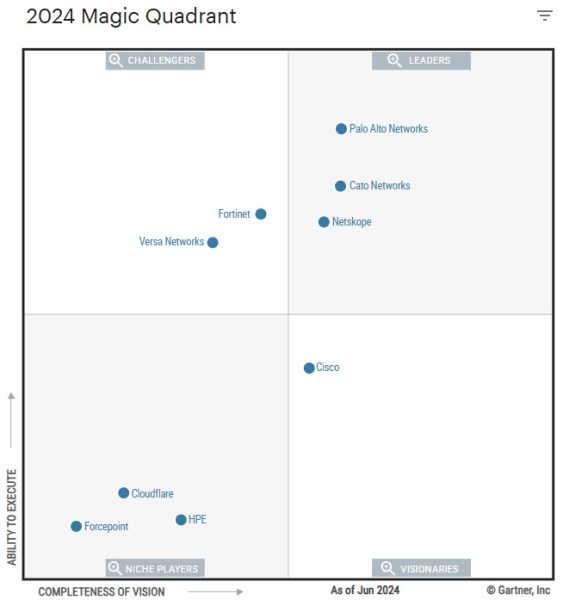

Gartner’s recognition of Cato Networks, Palo Alto Networks, and Netskope as market leaders in the single-vendor SASE space underscores the importance of unified platforms in reshaping enterprise security strategies. As organizations increasingly embrace consolidation, the benefits of improved visibility, reduced complexity, and enhanced security become more apparent.

In conclusion, the rise of SASE as a consolidator of security tech stacks represents a significant shift in the cybersecurity landscape. Organizations that embrace consolidation early on stand to gain a competitive advantage in terms of efficiency, visibility, and security resilience. As the market continues to evolve, the importance of unified platforms like SASE will only grow, making it a strategic consideration for security and infrastructure leaders looking to enhance their security posture. The pace of cyber attacks is outstripping the capabilities of integration teams, prompting experts to endorse the adoption of a converged security approach. In a world where AI-enabled attacks exploit the slightest gaps in multivendor stacks within a mere 200 milliseconds, every unmanaged connection poses a potential risk.

When it comes to Secure Access Service Edge (SASE) solutions, several key players stand out in the market. Cato Networks, for instance, offers a comprehensive SASE Cloud platform that seamlessly integrates SD-WAN, security service edge, Zero Trust Network Access (ZTNA), Cloud Access Security Broker (CASB), and firewall capabilities. Gartner has noted Cato’s exceptional customer experience and user-friendly interface as major strengths, although some capabilities such as SaaS visibility and on-premises firewalling are still evolving. Pricing may also vary depending on bandwidth requirements, impacting total deployment costs.

Palo Alto Networks, a well-established player in the market, is recognized for its robust security and networking features delivered through a unified platform. However, the high cost of the solution compared to other vendors and the less intuitive nature of the new Strata Cloud Manager interface have been flagged as potential drawbacks.

Netskope, on the other hand, offers a strong feature set encompassing both networking and security, coupled with a positive customer experience and a solid geographic strategy. Despite these strengths, operational complexity and the need for administrators to navigate multiple consoles for full functionality have been highlighted as areas for improvement.

When evaluating the leading SASE vendors, considerations such as platform design, ease of use, AI automation maturity, pricing transparency, and security scope come into play. Cato Networks, with its fully unified, cloud-native platform and excellent ease of use, is an ideal fit for midmarket and enterprise customers seeking simplicity. Palo Alto Prisma, known for its security-first integration and mature security operations automation, is recommended for enterprises already utilizing Palo Alto’s Next-Generation Firewall (NGFW). Netskope, with its focus on infrastructure control and strong CASB and data loss prevention capabilities, is well-suited for regulated industries and compliance-driven organizations.

The trend towards SASE consolidation underscores a fundamental shift in enterprise security architecture. With AI attacks constantly probing for vulnerabilities, the need for a single-vendor SASE solution that eliminates integration gaps and reduces latency has become paramount. Security leaders are increasingly opting for unified platforms to enhance both protection and operational efficiency, recognizing that simplicity and speed are key in today’s threat landscape. By consolidating SASE solutions, enterprises can mitigate risks, strengthen security posture, and keep pace with evolving cyber threats.