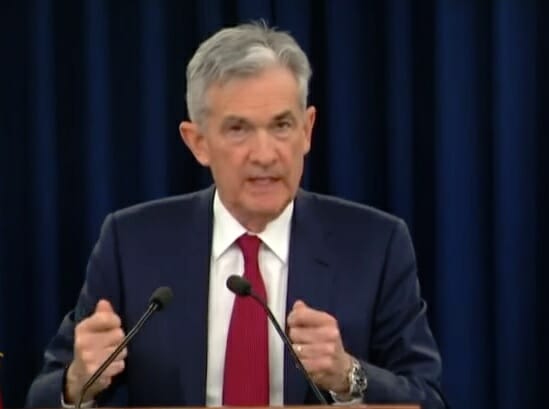

On Wednesday, Jerome Powell, the Chair of the Federal Reserve, made headlines with his announcement to maintain interest rates between 4.25% and 4.5%, despite recent positive economic indicators. This decision has sparked considerable debate about his leadership and the Fed’s current strategy.

Powell remarked to reporters that “the economy is doing fine,” suggesting a cautious approach as he awaits further clarity regarding economic conditions.

This stance has drawn significant criticism, particularly from former President Trump, who expressed his discontent back in April after Powell hinted at delaying interest rate cuts. Trump has been vocal in urging for Powell’s removal, claiming that his continued tenure could inflict further harm on millions of American workers.

President Trump: The European Central Bank is poised to cut interest rates for the seventh time, yet “Too Late” Jerome Powell, who seems to always be lagging behind, issued yet another convoluted report. With oil and grocery prices declining, it’s clear the U.S. economy is thriving on tariffs. It’s high time Powell lowered interest rates—he should have done it long ago. His termination cannot come soon enough!

Many observers echo Trump’s sentiment, questioning whether Powell’s decisions stem from incompetence or a more sinister agenda. The crux of the matter lies in how Powell’s actions have historically impacted the market.

Reflecting on Trump’s first term, the U.S. economy experienced remarkable growth, achieving historic highs in 2018. However, this momentum took a nosedive when Powell began implementing rate hikes, which many believe undermined the economic gains.

The Dow Jones Industrial Average plummeted over 5,000 points, marking a significant downturn that some analysts argue was more severe than the market crash following the September 11 attacks. In December 2019, the Dow fell 5,036 points from its peak on October 3, 2018, largely attributed to Powell’s rate hike announcements.

The repercussions of these decisions were profound: the middle class faced increased financial strain, and over $5 trillion in wealth was wiped out as a direct result of Powell’s policies. This decline was so drastic that many likened it to the economic fallout experienced during past national crises.

As Powell continues to grapple with the complexities of economic policy, many are left wondering: Can he reverse this trend? Despite the insistence that the economy is stable, the evidence suggests that Powell’s tenure might be doing more harm than good to American prosperity.

In conclusion, the ongoing debate surrounding Jerome Powell’s leadership raises critical questions about the effectiveness of the Federal Reserve’s current strategies. As economic conditions evolve, the spotlight remains on Powell—will he adapt to the needs of the market, or will he continue to be perceived as an impediment to economic recovery?

UPDATE: Following Powell’s latest comments, President Trump has once again taken to social media to voice his opinion on the matter, labeling Powell’s approach as misguided.