The Federal Reserve is gearing up for a crucial meeting this week, with key decisions to be made on interest rates and future economic forecasts. The meeting comes amid a backdrop of political tension and intrigue, as new appointees and dissenting voices add complexity to the central bank’s deliberations.

On the monetary front, the Federal Open Market Committee (FOMC) will announce its decision on the overnight borrowing rate, along with projections for future rate movements on the “dot plot” grid. The consensus expectation is for a quarter-point cut in the federal funds rate, but dissenting voices may push for a more aggressive move. President Trump’s appointee, Stephen Miran, is expected to advocate for a larger rate cut, aligning with the President’s calls for more aggressive monetary policy.

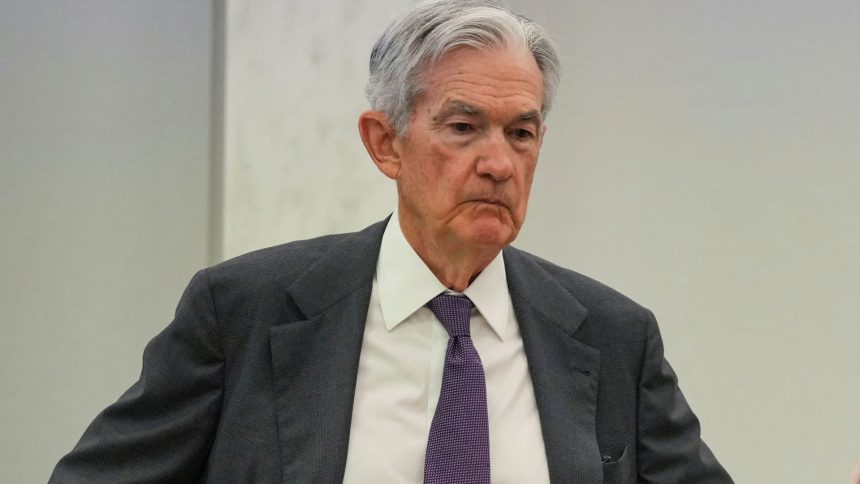

The political pressure on the Fed is evident, with Trump urging for bold rate cuts and signaling a desire to replace Chair Jerome Powell when his term expires. The presence of dissenting voices within the FOMC, including Miran and other Trump appointees, adds further uncertainty to the decision-making process.

Market expectations point towards a quarter-point rate cut this week, with further cuts likely in the coming months. However, the divergence of views within the FOMC and the influence of external political factors make the path forward uncertain. The upcoming meeting will provide insights into the Fed’s stance on future rate adjustments and its assessment of economic conditions.

Chair Powell’s post-meeting press conference will be closely watched for hints on the Fed’s future policy direction. His remarks at the recent Jackson Hole symposium indicated a dovish stance, emphasizing the importance of maintaining full employment amid changing economic conditions.

Overall, the Fed faces a challenging balancing act between economic objectives, political pressures, and market expectations. The outcome of this week’s meeting will have far-reaching implications for monetary policy and the broader economic outlook. Stay tuned for updates on the Fed’s decision and its impact on financial markets.